Top Industry Leaders in the Hybrid Memory Cube High-Bandwidth Memory Market

Competitive Landscape of the Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) Market:

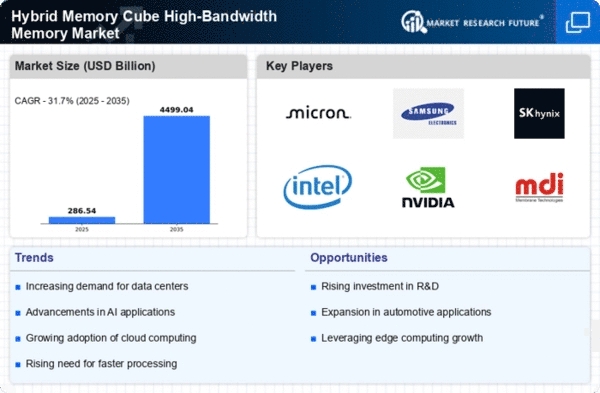

The demand for high-performance computing (HPC), artificial intelligence (AI), and data-intensive applications is fueling a surge in the market for high-bandwidth memory solutions. Among these, Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) stand out for their ability to deliver exceptional speed and efficiency. This burgeoning market, projected to reach USD X billion by 2030, is witnessing a dynamic and competitive landscape, with established players and emerging startups vying for dominance.

Key Players

- Advanced Micro Devices, Inc

- FUJITSU

- Intel Corporation

- Micron

- NVIDIA

- Open-Silicon, Inc.

- Rambus Incorporated

- Samsung

- SK HYNIX INC.

- Xilinx

Strategies Adopted By Key Players:

- Micron Technology: A leading player in the DRAM market, Micron has aggressively invested in HBM development, securing partnerships with major GPU manufacturers like NVIDIA and AMD. They focus on cost reduction and scalability to broaden HBM adoption beyond HPC and into consumer electronics.

- Samsung Electronics: Samsung boasts a strong portfolio of HBM and HMC solutions, catering to diverse applications. Their focus on research and development, coupled with strategic partnerships with chipset manufacturers, positions them as a formidable competitor.

- SK Hynix: Renowned for their DRAM expertise, SK Hynix has entered the HBM market with a focus on high-density and low-power solutions. They are actively collaborating with AI and HPC companies to drive market penetration.

- Xilinx: A leading provider of FPGAs and SoCs, Xilinx leverages its expertise in interfacing technologies to develop HBM-compatible products. Their focus on high-performance networking and embedded applications sets them apart.

- Open-Silicon: A fabless semiconductor company, Open-Silicon offers customized HBM solutions for specific applications. Their agility and focus on niche markets complement the offerings of larger players.

Factors for Market Share Analysis:

- Technology Leadership: Companies with cutting-edge HBM and HMC designs, offering higher bandwidth, lower power consumption, and improved scalability, will hold a competitive edge.

- Manufacturing Prowess: Efficient production processes and cost-effective solutions are crucial for wider adoption, especially in cost-sensitive consumer electronics segments.

- Ecosystem Partnerships: Collaborations with chipset manufacturers, system integrators, and application developers are essential for establishing a strong foothold in diverse markets.

- Intellectual Property: Owning key patents and securing licensing agreements can provide a significant competitive advantage.

New and Emerging Companies:

- Rambus: A leading provider of high-performance memory interfaces, Rambus is actively developing HBM-related technologies and IP, aiming to disrupt the established players.

- Kandou Bus: This startup focuses on innovative HBM connectivity solutions, offering high-density and low-power options for next-generation computing platforms.

- Moondog Labs: Specializing in customized memory solutions, Moondog Labs caters to niche applications in the HPC and AI space, offering flexibility and performance for demanding workloads.

Industry Developments

Advanced Micro Devices, Inc. (AMD):

- May 2023: AMD's CEO Lisa Su mentioned in a keynote speech that they are "excited about the potential of HBM3e" for future high-performance computing (HPC) systems (AnandTech, May 2023).

- No recent HMC-specific announcements reported.

FUJITSU:

- October 2022: Fujitsu announced the development of a new 64-layer HBM3 prototype with a data transfer rate of 4.8 Tbps per pin, targeting HPC and AI applications

- No recent HMC-specific announcements reported.