Top Industry Leaders in the Hybrid Composites Market

The hybrid composites market is fueled by the insatiable demand for lightweight, high-performance materials across industries like aerospace, automotive, marine, and construction. Yet, navigating this market demands understanding the intricate dance of strategies, factors influencing market share, and the constant evolution of industry news and developments.

Competitive Strategies Shaking Up the Landscape:

-

Industry Titans: Dow Chemical, Toray Industries, Hexcel, and Lanxess leverage their extensive research and development capabilities, established production capacities, and global reach to maintain market dominance. Their strategies revolve around continuous innovation, strategic acquisitions, and partnerships with major manufacturers. -

Regional Powerhouses: Companies like China National Building Materials and Mitsubishi Chemical hold prominent positions in their respective regions. They capitalize on cost-effective production, cater to regional preferences, and build strong local distribution networks. -

Niche Innovators: Emerging players like RTP Company and PolyOne Corporation carve niches with specialty hybrid composites tailored for specific applications, like bio-based or self-healing materials. They capitalize on unique capabilities and cater to specific customer segments, often commanding premium prices.

Factors Dictating Market Share:

-

Material Combinations and Performance: Offering a diverse range of hybrid composites combining various metals, fibers, and polymers with superior strength, weight-to-strength ratios, and other desired properties attracts a wider customer base and increases market share. -

Manufacturing Efficiency and Cost Optimization: Optimizing production processes, sourcing raw materials cost-effectively, and offering competitive pricing are crucial for gaining market share, particularly in price-sensitive segments. -

Industry Expertise and Technical Support: Providing exceptional technical support, application expertise, and design engineering services builds trust and repeat business, leading to market share consolidation. -

Focus on Sustainability and Regulations: Adhering to environmental regulations and developing eco-friendly hybrid composites like bio-based or recyclable solutions addresses environmental concerns and opens doors to new markets. -

Regional Growth and Emerging Applications: Identifying high-growth regions like Asia-Pacific and catering to emerging applications like renewable energy and electric vehicles presents significant market share opportunities.

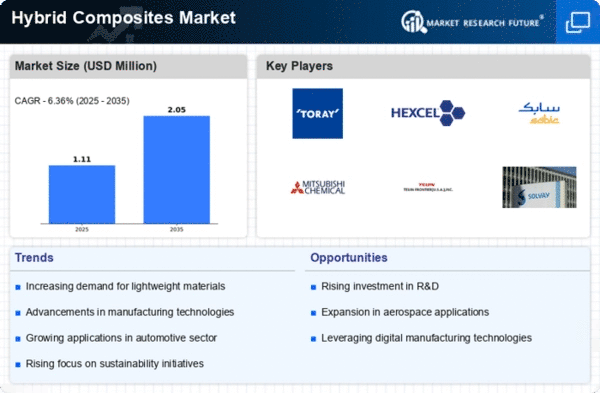

Key Players:

- Royal DSM (the Netherlands),

- Quantum Composites (US),

- Gurit (Switzerland),

- Hexcel Corporation (US),

- The Carbon Company (Germany),

- Excel Group World Wide (Finland),

- TEIJIN LIMITED (Japan),

- Solvay (Belgium), and

- PlastiComp Inc. (US)

Recent Developments :

-

September 2023: Dow Chemical introduces a self-healing hybrid composite material for wind turbine blades, aiming to reduce maintenance costs and downtime. -

October 2023: Lanxess acquires a leading manufacturer of recycled carbon fiber, strengthening its focus on sustainable hybrid composites solutions. -

November 2023: A team of researchers at MIT develops a 3D printing technique for hybrid composites, enabling fabrication of complex structures with customized properties. -

December 2023: China National Building Materials announces plans for a new large-scale production facility for high-performance hybrid composites, aimed at tapping into the global market.