Top Industry Leaders in the HVDC Capacitor Market

Competitive Landscape of the HVDC Capacitor Market:

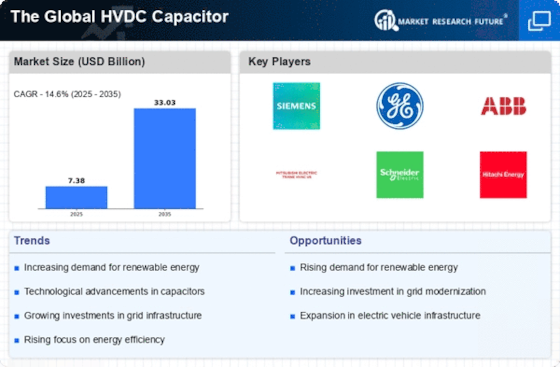

The High Voltage Direct Current (HVDC) capacitor market is experiencing a surge, propelled by the integration of renewable energy sources and the modernization of grids. This surge has ignited a dynamic competitive landscape, with established players battling for market share against emerging competitors. Understanding this landscape is crucial for both established and aspiring participants.

Key Players:

- Eaton Corporation PLC

- ABB Ltd

- RTDS Technologies Inc.

- Alstom SA

- Maxwell Technologies Inc

- Siemens AG

- Sieyuan Electric Co. Ltd

- Vishay Intertechnology Inc

- TDK Corporation

- AVX Corporation (Kyocera Corporation)

Strategies Adopted by Key Players:

Companies in the HVDC capacitor market employ a range of strategies to secure market share and growth:

- Product Diversification: Expanding product portfolios to cater to various voltage levels, applications, and installation types broadens customer appeal.

- R&D Investment: Continuously investing in research and development of new materials, designs, and manufacturing processes ensures technological leadership.

- Vertical Integration: Integrating production processes, from raw materials to finished products, can improve cost-efficiency and quality control.

- Digitalization and Automation: Implementing advanced digital solutions and automation in manufacturing and supply chains enhances efficiency and responsiveness.

- Sustainability Focus: Emphasizing environmentally friendly production processes and recyclable materials resonates with sustainability-conscious customers.

Market Share Analysis:

A handful of established players currently dominate the market. Companies like ABB, Siemens, Eaton, and Epcos-TDK have leveraged their technological expertise and brand recognition to secure significant market shares. However, several factors influence market share dynamics:

- Technological Prowess: Offering advanced capacitor technologies like self-healing film capacitors and dry-type designs that boost efficiency and reliability can be a game-changer.

- Geographical Focus: Targeting regions with significant HVDC projects, particularly those focusing on renewable energy integration, grants companies access to high-growth markets.

- Cost-Competitiveness: Striking a balance between cost and quality is critical, especially in price-sensitive emerging markets.

- Strategic Partnerships: Collaborations with key utilities, grid operators, and technology providers can open doors to larger projects and strengthen market presence.

New and Emerging Companies:

While established players reign supreme, new and emerging companies are chipping away at the market share. These innovators often focus on niche applications, customized solutions, or disruptive technologies:

- Start-ups: Agile and nimble, start-ups like Maxwell Technologies and General Atomics are introducing novel materials and designs, challenging the status quo.

- Regional Players: Companies like Hitachi (Japan) and TBEA (China) are capitalizing on their regional expertise and competitive pricing to gain traction in their respective markets.

- Technology Focus: Several players are specializing in specific HVDC capacitor technologies, like VSC-rated (Voltage Source Converter) capacitors or pole-mounted solutions, catering to evolving grid needs.

Industry Developments

Eaton Corporation PLC:

- Oct 2023: Eaton announced its new generation of Metallized Polypropylene (MPP) film capacitors for HVDC applications, offering higher energy density and reduced weight compared to traditional designs.

- Jun 2022: Eaton partnered with the National Renewable Energy Laboratory (NREL) on a research project to develop advanced filter designs for HVDC systems using silicon carbide (SiC) power electronics.

ABB Ltd:

- Dec 2023: ABB secured a major contract to supply HVDC capacitor systems for the ±500 kV Zhoushan II HVDC project in China, one of the world's largest offshore wind farms.

- Jul 2023: ABB unveiled its latest HVDC hybrid capacitor technology, combining film and electrolytic capacitors for improved performance and cost-efficiency.