Growing Focus on Indoor Air Quality

The HVAC Software Market is witnessing a heightened focus on indoor air quality (IAQ). As awareness of the health impacts of poor air quality increases, consumers are prioritizing HVAC systems that can effectively manage and improve IAQ. HVAC software plays a vital role in monitoring air quality parameters and ensuring that systems operate within optimal ranges. This trend is likely to drive the development of software solutions that provide real-time data and analytics on air quality, thereby enhancing the overall effectiveness of HVAC systems in maintaining healthy indoor environments.

Regulatory Compliance and Standards

The HVAC Software Market is significantly influenced by the need for compliance with various regulations and standards. Governments and regulatory bodies are increasingly implementing stringent energy efficiency and environmental regulations. HVAC software assists companies in adhering to these regulations by providing tools for monitoring and reporting energy usage and emissions. The market for HVAC software is projected to grow as businesses invest in solutions that ensure compliance with these evolving standards. This trend indicates a growing recognition of the importance of regulatory adherence in maintaining operational efficiency and sustainability.

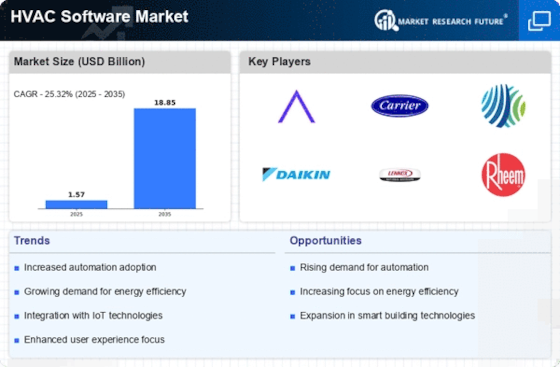

Rising Demand for Energy Efficiency

The HVAC Software Market is experiencing a notable increase in demand for energy-efficient solutions. As energy costs continue to rise, consumers and businesses alike are seeking ways to reduce their energy consumption. HVAC software plays a crucial role in optimizing system performance, leading to lower energy bills and reduced environmental impact. According to recent data, energy-efficient HVAC systems can reduce energy consumption by up to 30%. This trend is likely to drive the adoption of advanced HVAC software solutions that facilitate energy management and monitoring, thereby enhancing overall system efficiency.

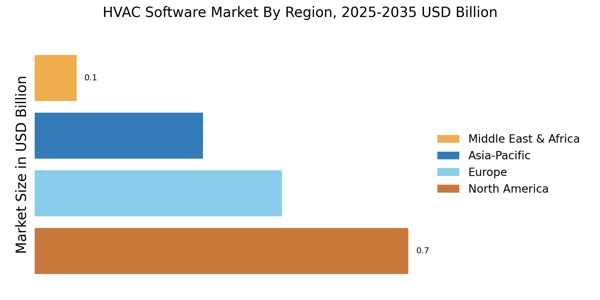

Expansion of Smart Building Technologies

The HVAC Software Market is closely linked to the expansion of smart building technologies. As buildings become increasingly automated, the integration of HVAC systems with building management systems is essential. HVAC software enables seamless communication between various building systems, optimizing energy use and enhancing occupant comfort. The market for HVAC software is projected to grow as more buildings adopt smart technologies that require sophisticated software solutions for effective management. This trend suggests a shift towards more integrated and intelligent building environments, where HVAC systems play a central role.

Technological Advancements in HVAC Systems

The HVAC Software Market is benefiting from rapid technological advancements in HVAC systems. Innovations such as smart thermostats, variable refrigerant flow systems, and advanced control algorithms are transforming the landscape of HVAC solutions. These technologies require sophisticated software for optimal operation and integration. The increasing complexity of HVAC systems necessitates the use of advanced software solutions that can manage and analyze data effectively. As a result, the demand for HVAC software is expected to rise, driven by the need for enhanced system performance and user experience.