Top Industry Leaders in the HVAC motors Market

*Disclaimer: List of key companies in no particular order

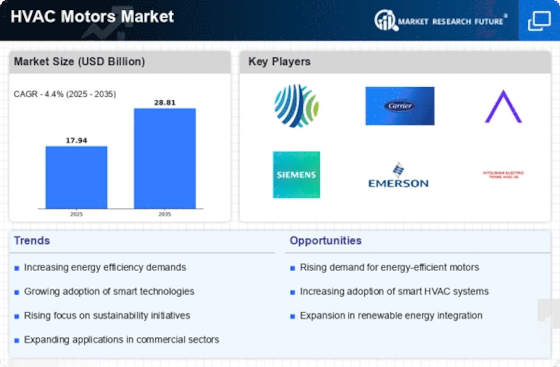

Top listed global companies in the HVAC motors industry are:

WEG (Brazil), Regal Beloit Corporation (US), Honeywell International Inc. (US), Ingersoll-Rand Plc, (Ireland), Johnson Controls (US), Mitsubishi Electric (Japan), Danfoss (Denmark), Hitachi (Japan), LG Electronics (South Korea), ABB (Switzerland), Siemens (Germany), Bosch Rexroth (Germany), and GE (US), among others.

Bridging the Gap by Exploring the Competitive Landscape of the HVAC motors Top Players

The HVAC motors market, powering the crucial systems that regulate our thermal comfort, is a dynamic and interconnected arena. With increasing focus on energy efficiency and building regulations, the landscape is characterized by a diverse range of players and evolving strategies. Let's delve into the key trends shaping this market's competitive landscape.

Key Players and Strategies:

Global Giants: Industry titans like Siemens, Emerson Electric, and Johnson Controls hold significant market share with extensive product portfolios catering to residential, commercial, and industrial applications. Their strategies revolve around R&D investments in high-efficiency motors, acquisitions of niche players, and global expansion through established distribution networks.

Regional Players: Companies like Nidec (Japan), WEG (Brazil), and TECO Electric (Taiwan) dominate specific regional markets based on cost-effective manufacturing and strong distribution channels. They often collaborate with OEMs and focus on customized solutions for regional building regulations and preferences.

Niche Specialists: A growing number of smaller players are carving out niches by specializing in innovative motor technologies like brushless DC motors, permanent magnet motors, and electronically commutated motors. These offer enhanced efficiency, quieter operation, and better speed control, appealing to customers seeking premium solutions.

Market Share Analysis:

Factors influencing market share dynamics include:

Product Portfolio: Companies with a broader range of motors for diverse applications attract a wider customer base.

Technological Expertise: Leading players with advanced R&D capabilities and focus on energy-efficient innovations can command premium prices and establish brand loyalty.

Geographic Presence: Strong regional presence through manufacturing facilities and distribution networks grants players an edge in specific markets.

Pricing Strategy: Balancing cost-effectiveness with quality allows players to cater to price-sensitive segments while maintaining profitability.

Customer Service and Support: Offering comprehensive after-sales support and technical expertise builds trust and fosters long-term customer relationships.

New and Emerging Trends:

Smart HVAC Systems: Integration of IoT and AI into HVAC systems is driving demand for intelligent motors equipped with sensors and communication capabilities for real-time performance monitoring and energy optimization.

Focus on Sustainability: Stringent energy regulations and increasing environmental awareness are prompting manufacturers to develop ultra-efficient motors with minimal energy consumption and eco-friendly materials.

Direct Drive Technology: Bypassing belt and pulley systems with direct-drive motors reduces energy losses and maintenance requirements, attracting interest for commercial and industrial applications.

Rise of Modular Design: Modular motor designs allow for easier customization and replacement of components, catering to the growing demand for flexibility and serviceability.

Overall Competitive Scenario:

The HVAC motors market is witnessing intense competition across all segments. While established players leverage their brand recognition and global reach, niche players are finding success with innovative technologies and customized solutions. Collaboration across the value chain, including partnerships with OEMs and building management systems providers, is becoming crucial for success. Sustainability, efficiency, and smart features are key differentiators, with players constantly adapting their strategies to meet evolving customer demands and regulatory requirements. As the market continues to grow, expect further consolidation, technological advancements, and a focus on creating intelligent and sustainable HVAC systems powered by next-generation motors.

Latest Company Updates:

October 26, 2023: WEG launches a new line of high-efficiency W22 IE5 permanent magnet motors for HVAC applications, targeting up to 20% energy savings compared to IE4 motors. (Source: WEG press release)

November 15, 2023: Regal Beloit announces the expansion of its FAS Veri-Drive Plus variable speed motor line for HVAC applications, offering improved efficiency and control capabilities. (Source: Regal Beloit press release)

September 20, 2023: Honeywell unveils its next-generation IntelliZone® zoning system with integrated variable speed motor control, enhancing comfort and energy efficiency in HVAC systems. (Source: Honeywell website news)

August 1, 2023: Ingersoll-Rand acquires a leading manufacturer of variable speed drives for HVAC applications, strengthening its position in energy-efficient solutions. (Source: Ingersoll-Rand press release)