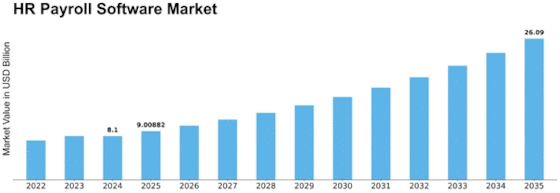

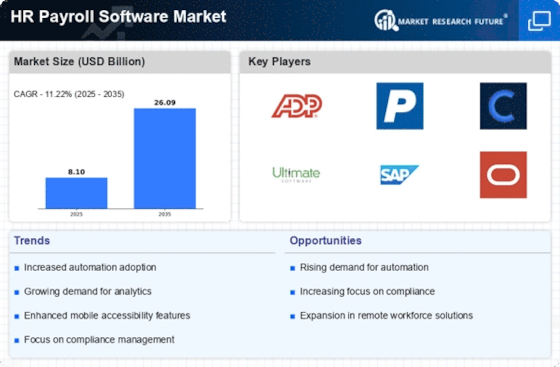

Hr Payroll Software Size

HR Payroll Software Market Growth Projections and Opportunities

The HR payroll software market is influenced by a myriad of market factors that collectively shape its dynamics and growth trajectory. One of the primary drivers is the increasing need for organizations to streamline and automate their human resources and payroll processes. As businesses expand and workforce management becomes more complex, there is a growing demand for efficient solutions to handle payroll calculations, tax compliance, and other HR-related tasks. Furthermore, technological advancements play a crucial role in shaping the HR payroll software market.

The advent of cloud computing has transformed the landscape, enabling companies to access payroll services remotely, leading to increased flexibility and scalability. Compliance with ever-evolving regulations is another significant market factor. The HR payroll software must adapt to changes in tax laws, labor regulations, and reporting requirements across different regions. Globalization is a key factor influencing the HR payroll software market as organizations expand their operations internationally. Managing payroll across multiple countries involves dealing with diverse tax codes, currencies, and labor laws. Therefore, companies are inclined to invest in comprehensive HR payroll software that can handle the intricacies of global payroll management, ensuring accuracy and compliance on a global scale.

Cost considerations also play a pivotal role in the adoption of HR payroll software. Small and medium-sized enterprises (SMEs) may opt for more cost-effective solutions with essential features. In contrast, larger enterprises may be willing to invest in robust, feature-rich platforms that cater to their complex payroll needs. The availability of various pricing models, including subscription-based and per-employee pricing, provides flexibility for organizations to choose a solution that aligns with their budget constraints. Competitive dynamics within the HR payroll software market are influenced by the presence of numerous vendors offering diverse features and functionalities.

Continuous innovation is crucial for companies to stay competitive and meet the evolving needs of their clients. Vendors often differentiate themselves through user-friendly interfaces, integration capabilities with other HR systems, and the ability to provide actionable insights through advanced analytics. Security concerns also shape the market landscape, with organizations prioritizing data protection and privacy. HR payroll software must adhere to strict security standards to safeguard sensitive team member information and financial data. Compliance with industry standards and certifications, such as GDPR and SOC 2, enhances the credibility of the software and instills confidence among users.

Leave a Comment