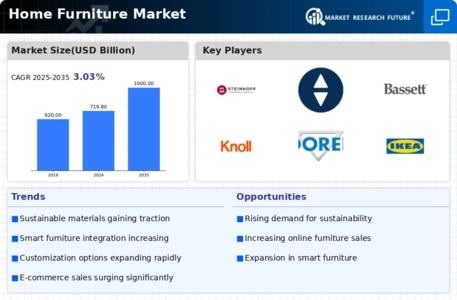

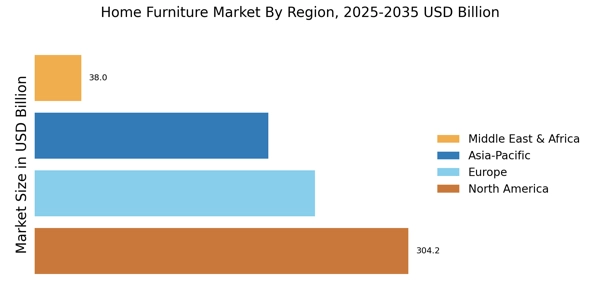

North America : Market Leader in Home Furniture Market

North America is the largest market for home furniture, accounting for approximately 40% of the global market share. Key growth drivers include rising disposable incomes, urbanization, and a growing trend towards home improvement. Regulatory support for sustainable materials and eco-friendly practices is also enhancing market dynamics. The U.S. and Canada are the leading countries, with the U.S. holding a significant portion of the market due to its robust retail infrastructure and consumer spending habits. The competitive landscape is characterized by major players such as IKEA, Ashley Furniture, and Steelcase, which dominate the market with innovative designs and extensive product ranges. The presence of established brands and a strong distribution network further solidify North America's position. Additionally, the increasing popularity of online shopping is reshaping consumer behavior, leading to a surge in e-commerce sales in the furniture sector.

Europe : Emerging Trends in Furniture Design

Europe is a significant player in the home furniture market, holding approximately 30% of the global share. The region is driven by a strong emphasis on design, sustainability, and innovation. Countries like Germany and Italy are at the forefront, with a growing demand for high-quality, eco-friendly furniture. Regulatory frameworks promoting sustainable practices are also influencing market growth, encouraging manufacturers to adopt greener production methods. Leading countries in Europe include Germany, Italy, and France, where a mix of traditional craftsmanship and modern design is prevalent. The competitive landscape features renowned brands such as Natuzzi and IKEA, which are known for their stylish and functional offerings. The market is also witnessing a rise in local artisans and small manufacturers, contributing to a diverse and dynamic furniture landscape. The European market is increasingly focused on customization and personalization, catering to evolving consumer preferences.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific is rapidly emerging as a key player in the home furniture market, accounting for approximately 25% of the global share. The region's growth is fueled by urbanization, rising disposable incomes, and a burgeoning middle class. Countries like China and India are leading this growth, with increasing demand for both traditional and modern furniture styles. Regulatory initiatives aimed at promoting sustainable practices are also gaining traction, further enhancing market dynamics. Developed markets such as Japan and the Australia home furniture market continue to show steady demand, driven by premium furniture adoption and sustainable design preferences.

China is the largest market in the region, followed by India, where local manufacturers are increasingly competing with international brands. The competitive landscape is characterized by a mix of established players and new entrants, with companies like Dorel Industries and Flexsteel gaining prominence. The rise of e-commerce platforms is transforming the retail landscape, making furniture more accessible to consumers across the region. Additionally, the growing trend of home renovation and interior design is driving demand for innovative and stylish furniture solutions.

Middle East and Africa : Untapped Potential in Furniture Market

The Middle East and Africa region is witnessing a gradual but steady growth in the home furniture market, holding approximately 5% of the global share. Key growth drivers include urbanization, increasing disposable incomes, and a growing interest in home aesthetics. Countries like South Africa and the UAE are leading the market, with a rising demand for luxury and contemporary furniture. Regulatory frameworks are slowly evolving to support sustainable practices, which could further enhance market growth in the future. In the competitive landscape, local manufacturers are increasingly emerging alongside international brands, creating a diverse market environment. Key players include local artisans and larger companies that cater to both traditional and modern tastes. The region's unique cultural influences are reflected in furniture designs, making it a vibrant market. The growing trend of online shopping is also reshaping consumer behavior, providing new opportunities for growth in the furniture sector.