Top Industry Leaders in the High Temperature Thermoplastics Market

In the fiery crucible of industry, where temperatures soar and demands are intense, a class of materials emerges triumphant – high-temperature thermoplastics (HTTs). These remarkable polymers possess the strength and resistance to withstand scorching temperatures, pushing the boundaries of engineering and innovation across diverse sectors. However, navigating this dynamic landscape requires heat-resistant strategies and unwavering dedication to performance.

Key Strategies Shaping the Market:

-

Product Diversification: Leading players like Solvay, Evonik, and Quadrant Plastic Products are continuously expanding their HTT portfolios, introducing formulations tailor-made for specific applications and temperature thresholds. This differentiation caters to niche markets and fosters customer loyalty. -

Vertical Integration: Securing control over upstream resources like key monomers and additives is crucial for ensuring stable supply chains and cost competitiveness. Companies like SABIC Innovative Plastics are actively pursuing vertical integration, gaining control over critical resources. -

Technological Advancements: Continuous research and development in novel HTT formulations, improved processing techniques, and innovative filler materials are vital for sustained growth. Chevron Phillips Chemical Company's recent breakthrough in using recycled carbon fiber as reinforcement for HTTs exemplifies this commitment to cutting-edge solutions. -

Geographic Expansion: Emerging economies like China and India present immense potential for HTT consumption, driven by rapid industrialization and infrastructure development. Companies like Asahi Kasei are strategically building production facilities in these regions to capitalize on the growing demand. -

Sustainability Focus: Environmental concerns surrounding traditional polymer production and the end-of-life management of HTTs are pushing manufacturers towards eco-friendly alternatives and closed-loop recycling systems. Arkema's focus on developing bio-based HTTs and implementing recycling initiatives demonstrates this responsible approach.

Factors Dictating Market Share:

-

Brand Reputation and Reliability: Established players with proven track records like BASF and DSM enjoy significant market share due to their brand recognition and consistent quality. However, innovative startups addressing specific high-performance applications can still carve out their space. -

Cost Competitiveness: Optimizing production processes and sourcing affordable raw materials are crucial for cost leadership. Asian manufacturers often have an edge due to lower labor costs, but premium brands command higher prices due to superior performance and environmental credentials. -

Technical Expertise and Support: Extensive knowledge of material properties, design guidance, and post-processing support are essential for customer satisfaction and repeat business. Companies like Ensinger excel in this area. -

Regulatory Landscape: Stringent fire safety regulations, especially in Europe and North America, are pushing manufacturers towards flame-retardant HTTs with low smoke emission. Adapting to evolving regulations and developing compliant products becomes crucial for market success.

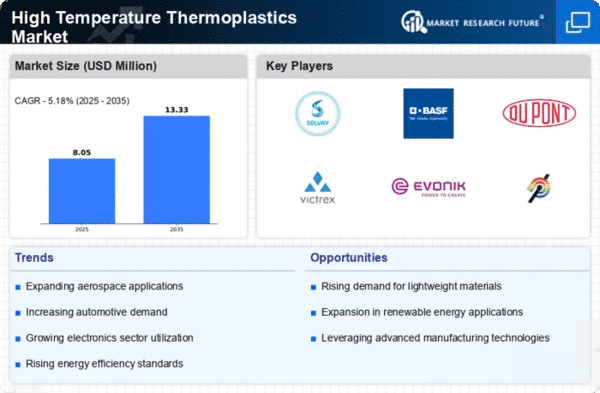

Key Players:

BASF SE (Germany), Celanese Corporation (U.S.), Solvay (Belgium.), Arkema (France), Evonik Industries AG (Germany), DowDuPont ( U.S.), SABIC (Saudi Arabia), Victrex plc (U.K), Royal DSM (the Netherlands), and TORAY INDUSTRIES, INC (Japan) among others.

Industry News and Recent Developments:

September 2023: The Indian government announces plans to upgrade its oil and gas infrastructure using high-temperature resistant piping made from advanced PEEK materials, boosting demand in the energy sector.

October 2023: The European Union proposes stricter regulations on volatile organic compound (VOC) emissions from industrial processes, challenging traditional HTT production methods but promoting development of low-VOC alternatives.

November 2023: Evonik unveils a new line of bio-based PAEK grades made from plant-based oils, targeting eco-conscious consumers and opening doors for sustainable material choices in high-temperature applications.

December 2023: A consortium of leading HTT manufacturers announces the formation of a research alliance to develop standardized testing protocols, assess the life cycle assessment of HTTs, and explore possibilities for closed-loop recycling systems.