Top Industry Leaders in the High Temperature Elastomers Market

The high-temperature elastomers (HTE) market is a dynamic and ever-evolving space, driven by advancements in material science and the growing demand from demanding industries like aerospace, automotive, and oil & gas. This report delves into the competitive landscape, analyzing key strategies, market share factors, industry news, and recent developments shaping the future of HTEs.

Strategies for Growth:

-

Product Innovation: Leading players like Dow Corning and Momentive Performance Materials are investing heavily in R&D, developing next-generation HTEs with enhanced thermal resistance, chemical stability, and mechanical properties. Recent examples include Dow Corning's Sylgard® 5000 series for extreme high-temperature applications and Momentive's Silopren® LSR 4600 for low-temperature flexibility. -

Strategic Partnerships and Acquisitions: Mergers and acquisitions are a growing trend, with companies like Solvay acquiring Chemours' fluoroelastomer business to strengthen their market position and access new technologies. Collaborations with research institutions and universities are also fostering innovation and talent acquisition. -

Geographic Expansion: Emerging economies like China and India are witnessing rapid growth in industries like automotive and infrastructure, creating lucrative opportunities for HTE manufacturers. Companies are establishing production facilities and distribution networks in these regions to cater to the local demand. -

Sustainability Focus: Environmental concerns are driving the development of bio-based and recyclable HTEs. Companies like Lanxess are offering bio-based fluoroelastomers made from renewable resources, while 3M is focusing on developing recyclable silicone elastomers.

Factors Influencing Market Share:

-

Brand Reputation and Product Quality: Established brands like Dow Corning and DuPont enjoy a strong reputation for quality and reliability, giving them an edge in competitive bidding. -

Technological Expertise and Innovation: Companies with robust R&D capabilities and a track record of successful product launches are well-positioned to gain market share. -

Cost-Effectiveness and Supply Chain Efficiency: Optimizing production processes, sourcing raw materials efficiently, and maintaining a lean supply chain are crucial for cost competitiveness. -

Customer Service and Technical Support: Providing excellent customer service and technical support builds trust and loyalty among customers, leading to repeat business and market share growth.

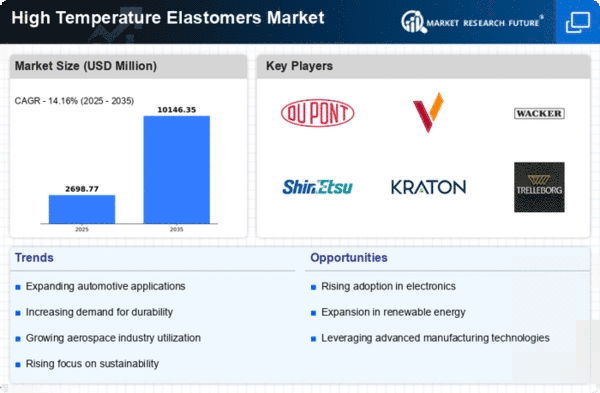

List of Key Players in the High-Temperature Elastomers Market:

- Dow Corning Corporation (U.S.)

- Wacker Chemie Ag( Germany)

- Momentive (U.S.)

- Shin-Etsu Chemical Co., Ltd (Japan)

- China National Bluestar (Group) Co. Ltd (China)

- Daikin Industries Ltd (Japan), DuPont (U.S)

- KCC Corporation (South Korea)

- Solvay S.A (Belgium)

- 3M Company (U.S.)

Recent Developments:

A novel alternative to leather was developed by DOW in April 2024 using polyolefin elastomers (POE) for the automotive industry’s transition to animal-free materials. Dow’s POE leather has a number of benefits that allow designers to work with more color options as it is very soft, and its color does not go off quickly, especially when new and lighter colors are introduced. Additionally, it demonstrates excellent resistance against weathering even at low temperatures while maintaining its performance features recommended for the automobile industry. Such factors are expected to fuel demand growth.

For instance, in December 2023, Fraunhofer Institute for Microstructure of Materials and Systems IMWS collaborates with partners aiming at developing an industrially viable, fully bio-based, non-toxic plasticizer for use on elastomers and thermoplastic materials. By employing canola oil as one of its main constituents there is potential development of more environmentally friendly alternatives for tires or packaging purposes. The project partners also aim to create a matching prototype facility in central Germany as a component of the "Biocerine" initiative.

For instance in August 2023, Covestro commenced operations at its new Shanghai manufacturing plant for polyurethane elastomer systems constructed after being commissioned during the summer of 2022. This facility is one in a series of investments that have been made by Covestro over the past few years in elastomers raw materials and which have been situated in various places including Thailand and Spain. The new plant is being constructed to cater to the demand for materials in the APAC area, particularly for renewable energy applications e.g., offshore cable protection and silicon wafer-cutting rollers used in photovoltaic panels.