Rising Demand for Personalized Medicine

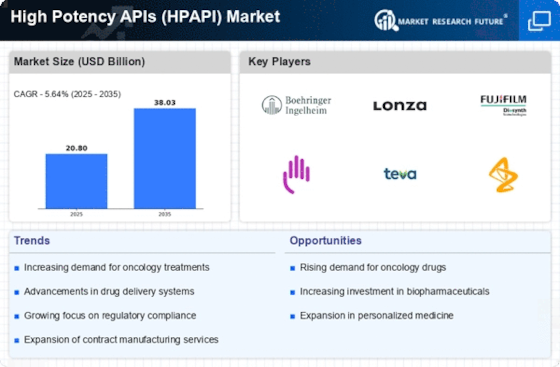

The shift towards personalized medicine is significantly influencing the High Potency APIs Market. As healthcare moves towards tailored treatment approaches, the need for high potency APIs that can be customized for individual patient profiles is becoming more pronounced. This trend is driven by the recognition that one-size-fits-all therapies may not be effective for all patients. Market analysis indicates that the personalized medicine segment is growing rapidly, with high potency APIs playing a crucial role in the development of these targeted therapies. As more healthcare providers adopt personalized treatment plans, the demand for high potency APIs is expected to increase, further propelling market growth.

Growing Investment in Biopharmaceuticals

The biopharmaceutical sector is experiencing significant investment, which is likely to drive the High Potency APIs Market. With an increasing number of biopharmaceutical companies focusing on the development of monoclonal antibodies and other biologics, the demand for high potency APIs is expected to rise. These compounds are crucial for the formulation of biologics that require precise dosing and efficacy. Market data suggests that the biopharmaceutical market is expanding rapidly, with projections indicating a substantial increase in revenue over the next few years. This growth is anticipated to create a favorable environment for high potency APIs, as companies seek to enhance their product offerings.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a primary driver of the High Potency APIs Market. As these conditions become more prevalent, there is a growing need for effective treatment options. High potency active pharmaceutical ingredients are essential in developing targeted therapies that can address these complex diseases. According to recent data, the market for oncology drugs, which often utilize high potency APIs, is projected to reach substantial figures in the coming years. This trend indicates a robust demand for high potency APIs, as pharmaceutical companies strive to innovate and provide effective solutions for patients suffering from chronic ailments.

Regulatory Support for Advanced Therapies

Regulatory bodies are increasingly supporting the development of advanced therapies, which is likely to bolster the High Potency APIs Market. Initiatives aimed at expediting the approval process for innovative drugs, particularly those utilizing high potency APIs, are becoming more common. This regulatory environment encourages pharmaceutical companies to invest in research and development, leading to a surge in the production of high potency APIs. The introduction of guidelines that facilitate the safe handling and manufacturing of these potent compounds further enhances market growth. As a result, the industry is witnessing a shift towards more complex formulations that leverage the benefits of high potency APIs.

Technological Advancements in Drug Development

Technological innovations in drug development are playing a pivotal role in shaping the High Potency APIs Market. The emergence of advanced manufacturing techniques, such as continuous processing and nanotechnology, is enhancing the efficiency and safety of high potency API production. These advancements not only improve yield but also reduce the risk associated with handling potent compounds. As pharmaceutical companies adopt these technologies, the market for high potency APIs is likely to expand. Furthermore, the integration of automation and data analytics in manufacturing processes is expected to streamline operations, thereby fostering growth in the high potency APIs sector.