Top Industry Leaders in the High Performance Polyester Market

The High Performance Polyester (HPP) market is a tapestry woven with innovation and resilience. These specialty fabrics, boasting enhanced strength, heat resistance, and chemical stability, find their way into demanding applications like aerospace, automotive, and medical textiles. But beneath the seemingly smooth surface lies a competitive landscape as dynamic as the fibers themselves, where established players and ambitious newcomers vie for market share.

The High Performance Polyester (HPP) market is a tapestry woven with innovation and resilience. These specialty fabrics, boasting enhanced strength, heat resistance, and chemical stability, find their way into demanding applications like aerospace, automotive, and medical textiles. But beneath the seemingly smooth surface lies a competitive landscape as dynamic as the fibers themselves, where established players and ambitious newcomers vie for market share.

Strategies Stitching Success:

-

Product Diversification: Companies like DuPont, Teijin, and Toray Industries are constantly pushing the boundaries with new HPP formulations offering superior flame retardancy, enhanced conductivity, and tailored properties for specific industries. Think fire-resistant fabrics for racing suits and lightweight composites for aircraft panels. -

Vertical Integration: Securing a reliable supply of high-purity monomers and advanced processing technologies is crucial. Some players, like Asahi Kasei, are investing in backward integration to gain control over the supply chain and mitigate cost fluctuations. -

Focus on Sustainability: Environmental consciousness is shaping the market. Players are adopting greener production processes, using recycled materials, and developing bio-based HPP alternatives to minimize environmental impact and cater to eco-conscious consumers. -

Technological Advancements: Research and development efforts are leading to next-generation spinning techniques, novel fiber treatments, and innovative coatings, further enhancing the performance and functionality of HPP fabrics.

Factors Weaving the Market Fabric:

-

Aerospace and Automotive Demand: These industries remain primary drivers, with HPP fabrics finding use in aircraft interiors, fuel lines, and composite body panels. Technological advancements in these sectors create new opportunities for specialized HPP solutions. -

Regulation and Safety: Stringent regulations on fire safety and heat protection in industries like automotive and construction drive the demand for HPP fabrics. Companies compliant with these regulations gain a competitive edge. -

Innovation and Differentiation: Developing HPP fabrics with unique properties and tailored functionalities for specific applications is key to differentiation and customer retention. Think self-healing fabrics for wearables and conductive fabrics for smart textiles. -

Geographical Expansion: Emerging economies in Asia and Africa present immense growth potential for applications like protective clothing and filtration fabrics. Companies establishing production facilities and partnerships in these regions are well-positioned to capitalize on this trend.

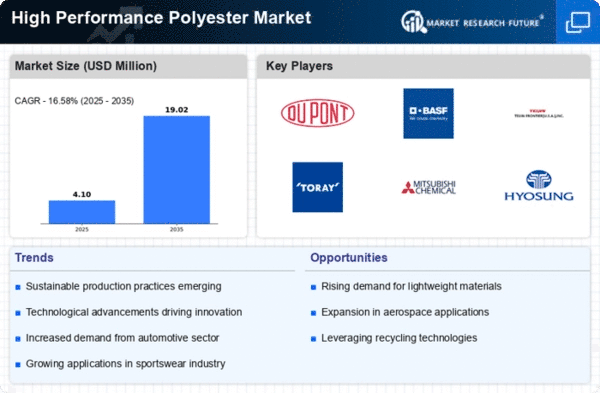

Key Players:

Some of the prominent players operating in the Global High Performance Polyester Market are

- Celanese Corporation (U.S)

- Solvay S.A. (Belgium)

- DuPont (U.S)

- Evonik (Germany)

- Satyen Polymers Pvt. Ltd (India)

- The Shepherd Chemical Company (U.S)

- U-PICA Company Ltd. (Japan)

- Eastman Chemical Company (U.S)

- Ashland.(U.S)

- BASF SE (Germany)

Recent Developments:

-

September 2023: The European Union unveils stricter regulations on flame retardants in textiles, prompting innovation in the development of safer and more efficient flame-resistant HPP formulations. -

October 2023: DuPont unveils a bio-based HPP fabric made from renewable resources, marking a significant step towards sustainable production in the industry. -

November 2023: A consortium of leading universities and tech companies launches a research project to develop self-healing HPP fabrics for use in protective clothing and wearable electronics. -

December 2023: The HPP market shows signs of stabilization following a period of price volatility, with cautious optimism for steady growth in 2024 driven by increasing demand and technological advancements.