Expansion of Smart City Initiatives

The High Brightness LED Market is significantly influenced by the expansion of smart city initiatives across various regions. As urban areas evolve, there is a growing emphasis on integrating advanced lighting solutions that enhance public safety and energy management. High brightness LEDs are being deployed in street lighting systems, providing not only improved visibility but also the capability for remote monitoring and control. This integration aligns with the broader goals of smart city development, which aims to optimize resource use and improve the quality of urban life. Recent reports suggest that investments in smart city projects are expected to reach trillions of dollars in the coming years, creating a robust demand for high brightness LED solutions. Consequently, this trend is likely to serve as a catalyst for growth within the High Brightness LED Market.

Rising Demand for Energy Efficiency

The High Brightness LED Market is experiencing a notable surge in demand for energy-efficient lighting solutions. As energy costs continue to rise, consumers and businesses alike are increasingly seeking alternatives that reduce electricity consumption. High brightness LEDs, known for their superior efficiency compared to traditional lighting technologies, are becoming the preferred choice. According to recent data, the adoption of high brightness LEDs can lead to energy savings of up to 80%. This trend is further fueled by government initiatives promoting energy-efficient technologies, which are likely to enhance the market's growth trajectory. The shift towards energy efficiency not only addresses environmental concerns but also aligns with economic incentives, making it a pivotal driver in the High Brightness LED Market.

Increased Focus on Sustainable Practices

The High Brightness LED Market is benefiting from an increased focus on sustainable practices among consumers and businesses. As environmental awareness rises, there is a growing preference for products that minimize ecological impact. High brightness LEDs, which are free from hazardous materials like mercury and have a longer lifespan, align well with these sustainability goals. Furthermore, the ability of high brightness LEDs to significantly reduce energy consumption contributes to lower carbon footprints. Recent data indicates that the market for sustainable lighting solutions is expanding rapidly, with high brightness LEDs at the forefront of this movement. This shift towards sustainability not only enhances the appeal of high brightness LEDs but also positions them as a key player in the evolving landscape of the High Brightness LED Market.

Growth in Automotive Lighting Applications

The High Brightness LED Market is witnessing significant growth driven by the increasing adoption of LEDs in automotive lighting applications. As vehicle manufacturers strive to enhance safety and aesthetics, high brightness LEDs are being integrated into headlights, taillights, and interior lighting. This shift is supported by the fact that high brightness LEDs offer superior illumination, longer lifespan, and lower power consumption compared to conventional lighting solutions. Recent statistics indicate that the automotive segment is projected to account for a substantial share of the overall market, with a compound annual growth rate of approximately 10% over the next few years. This trend underscores the importance of high brightness LEDs in modern automotive design, thereby propelling the High Brightness LED Market forward.

Technological Innovations in LED Manufacturing

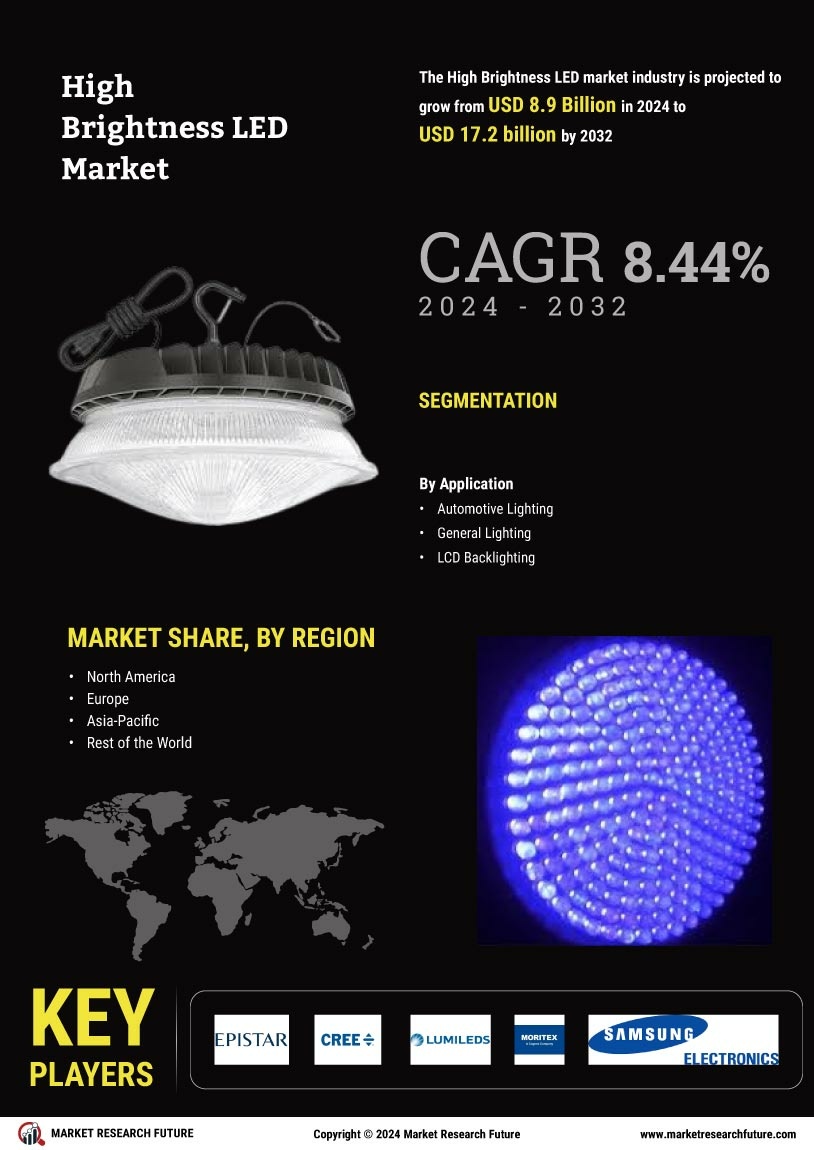

The High Brightness LED Market is propelled by ongoing technological innovations in LED manufacturing processes. Advances in materials science and engineering have led to the development of more efficient and durable high brightness LEDs. Innovations such as improved chip designs and enhanced thermal management systems are enabling manufacturers to produce LEDs that deliver higher luminosity while consuming less power. This technological evolution is crucial, as it allows for the creation of versatile applications across various sectors, including residential, commercial, and industrial lighting. Recent analyses suggest that the market for high brightness LEDs is expected to grow at a compound annual growth rate of around 8%, driven by these advancements. As manufacturers continue to innovate, the High Brightness LED Market is likely to experience sustained growth and diversification.