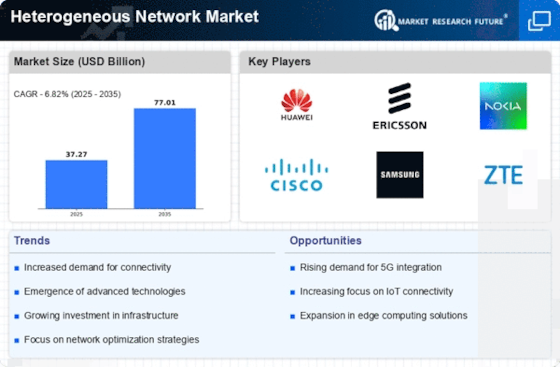

Top Industry Leaders in the Heterogeneous Network Market

Competitive Landscape of Heterogeneous Network Market:

The competitive landscape of the Heterogeneous Network (HetNet) market is marked by intense rivalry among key players, each striving to carve a niche in this dynamic industry. The market, driven by the ever-growing demand for seamless connectivity and efficient data transmission, witnesses strategic maneuvers and investments aimed at gaining a competitive edge. Several factors contribute to the competitive dynamics, including technological advancements, market expansion strategies, and innovative product offerings.

Key Players:

- Airhop Communications Inc. (US)

- Nokia Networks (Finland)

- Samsung Electronics Co., Ltd. (South Korea)

- Texas Instruments Inc. (US)

- NEC Corporation (Japan)

- Ruckus Wireless, Inc. (US)

- IP access Limited (UK)

- Ceragon Networks Ltd. (Israel)

- TE Connectivity (Switzerland)

- CommScope Inc. (US)

Strategies Adopted:

- Technological Innovation: Key players continually invest in research and development to stay ahead in the HetNet market. This involves the development of advanced small cell solutions, optimization algorithms, and integration with emerging technologies like 5G.

- Global Market Expansion: Companies are expanding their presence in both developed and emerging markets. Strategic alliances and partnerships with local players help in navigating diverse market landscapes and addressing region-specific needs.

- Diversification of Product Portfolio: To cater to the evolving demands of consumers, companies are diversifying their HetNet solutions. This includes the integration of artificial intelligence, IoT, and other cutting-edge technologies to enhance network efficiency.

Factors for Market Share Analysis:

- Technology Leadership: Companies with a technological edge in small cell development, network optimization algorithms, and seamless integration capabilities gain a larger market share.

- Global Presence: Market share is influenced by the geographical footprint of companies. Those with a wider global presence and the ability to adapt solutions to regional requirements tend to capture a larger market share.

- Customer Satisfaction: Customer-centric approaches, including reliable customer support and customized solutions, contribute to higher market share as satisfied clients are likely to continue and expand their partnerships.

- Strategic Collaborations: Joint ventures, collaborations, and partnerships with other industry leaders or regional players can significantly impact market share by expanding the reach and capabilities of the involved companies.

New and Emerging Companies:

- Mavenir: This emerging player focuses on cloud-native network solutions and has gained traction in the HetNet market with its innovative approach to mobile network infrastructure.

- Airspan Networks: Specializing in 5G and small cell solutions, Airspan Networks is gaining prominence as an agile and innovative player in the HetNet sector.

- Parallel Wireless: Known for its open RAN solutions, Parallel Wireless is disrupting the market by offering cost-effective and flexible HetNet solutions suitable for various deployment scenarios.

Current Company Investment Trends:

- 5G Technologies: Key players are heavily investing in 5G technologies to stay at the forefront of network evolution. This includes the development of 5G-enabled small cells and the integration of 5G capabilities into existing HetNet solutions.

- Artificial Intelligence (AI) Integration: Companies are investing in AI to optimize network performance, automate operations, and enhance the overall efficiency of HetNet solutions.

- Edge Computing: Recognizing the importance of edge computing in reducing latency, companies are directing investments toward developing HetNet solutions that incorporate edge computing capabilities.

- Sustainability Initiatives: With a growing emphasis on sustainability, companies are investing in eco-friendly solutions and energy-efficient technologies to reduce the environmental impact of HetNet infrastructure.

Latest Company Updates:

October 26, 2023: Cisco announces new Catalyst 9000X switches with advanced automation and security features for multi-cloud and hybrid network environments.

November 15, 2023: Nokia and Ericsson sign a patent cross-licensing agreement, promoting collaboration and innovation in 5G and advanced network technologies.

December 12, 2023: Juniper Networks unveils its cloud-native Contrail Service Orchestration platform, simplifying network management for service providers and enterprises.

January 10, 2024: The Open Network Foundation (ONF) launches a new initiative focused on open source network automation tools for heterogeneous networks.