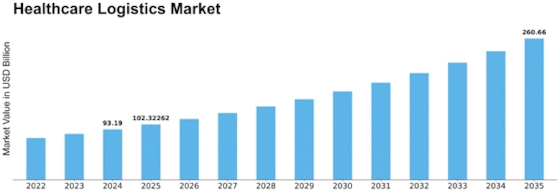

Healthcare Logistics Size

Healthcare Logistics Market Growth Projections and Opportunities

The healthcare logistics market is appreciably influenced by the globalization of healthcare services and the demand for efficient supply chain solutions. As healthcare carriers and pharmaceutical agencies amplify their operations across the world, there may be a growing demand for logistics offerings that could ensure the seamless transportation of medical supplies, devices, and prescription drugs across borders. The expanding pharmaceutical enterprise is a first-rate factor shaping the healthcare logistics marketplace. With increasingly more pharmaceutical merchandise being advanced and synthetic globally, the need for specific and timely distribution becomes vital. Efficient logistics answers are important to ensure that prescription drugs reach their locations in compliance with regulatory requirements. The growing need for temperature-sensitive transportation, mainly for biopharmaceuticals and vaccines, has led to the emergence of bloodless chain logistics within the healthcare zone. The capacity to keep particular temperature conditions for the duration of transportation is an essential issue shaping the healthcare logistics marketplace, ensuring the integrity of biologics and other temperature-touchy products. Advancements in generation, which include actual-time tracking and tracking structures, have revolutionized healthcare logistics. The use of RFID (Radio-Frequency Identification), IoT (Internet of Things), and facts analytics enhances the visibility and traceability of clinical shipments, offering more management and transparency in the delivery chain. The shift towards patient-centric care fashions has motivated the healthcare logistics marketplace. Timely and dependable delivery of scientific elements and gadgets at once influences affected persons' consequences, making efficient logistics crucial for healthcare carriers aiming to beautify the overall patient revel. Many healthcare corporations prefer to outsource their logistics features to specialized third-celebration vendors. This outsourcing trend is driven by the choice to pay attention to center healthcare activities, even leveraging the understanding of logistics partners to streamline supply chain operations, contributing to the growth of the healthcare logistics marketplace. The COVID-19 pandemic highlighted the importance of robust and resilient healthcare logistics structures. The need for fast and giant distribution of scientific supplies, together with vaccines, at some point of emergency underscores the crucial role of healthcare logistics in pandemic preparedness, influencing investment and strategic decisions inside the market.

Leave a Comment