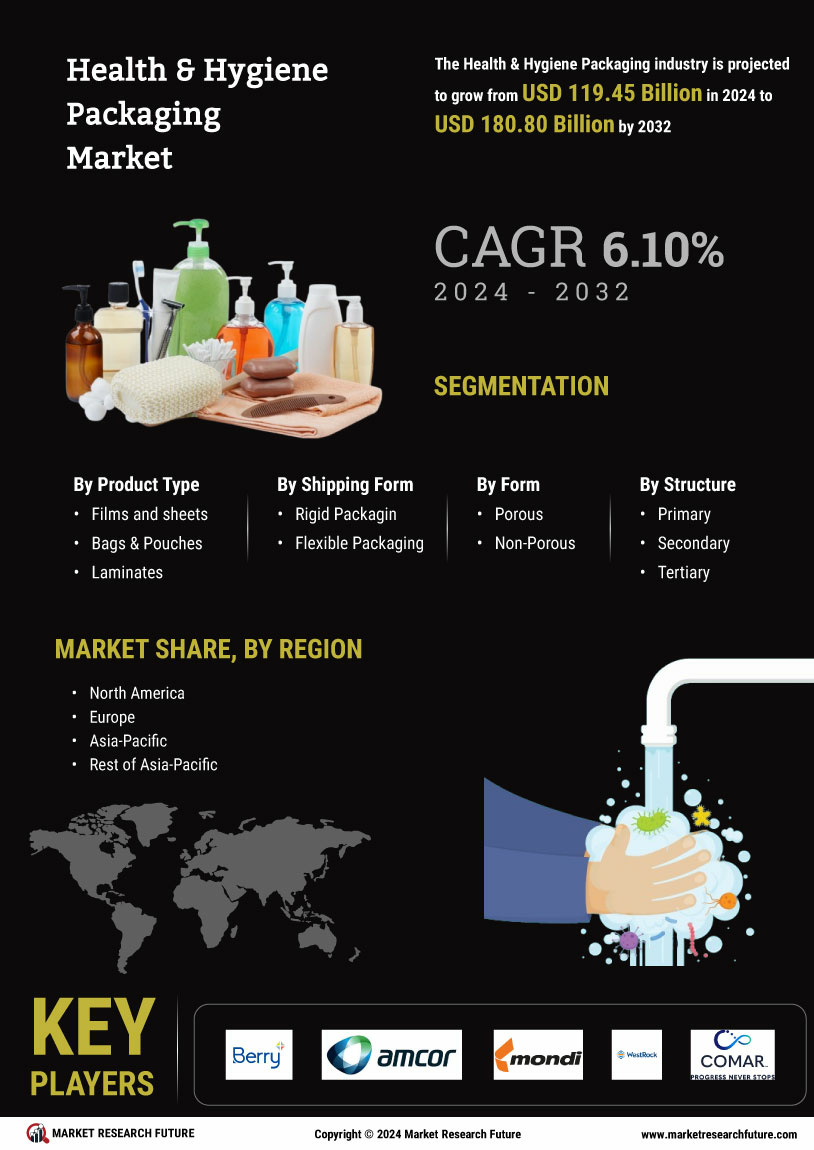

Leading market players are investing heavily in research and development to expand their product lines, which will help the Health & Hygiene Packaging market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Health & Hygiene Packaging industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Health & Hygiene Packaging industry to benefit clients and increase the market sector. In recent years, the Health & Hygiene Packaging industry has offered some of the most significant advantages to the healthcare and consumer goods sectors. Major players in the Health & Hygiene Packaging Market, including Berry Global, Amcor Plc, Mondi Group, WestRock, Kimberly Clark, Glenroy, Inc, Sonoco Products Company, Comar Packaging Solutions, Amerplast Ltd, and Essity, are attempting to increase market demand by investing in research and development operations.

Berry is a supplier of rigid, flexible, and non-woven products, offering a wide range of items, including closures and dispensing systems, pharmaceutical devices packaging, bottles and canisters, containers, technical components, and various films. The company markets its products under several brands such as Wavegrip, Sustane, Terram, Ruffies, Typar, Sunfilm, Novagryl, Reicrop, Tubex, Covertan, Adchem, AgFlex, Visqueen, Nashua, Patco, Fabrene, Ludlow Tape, Polyken, Polybale, Reemay, Geca Tapes, Chicopee, and EarthSense. These products cater to various industries, including healthcare, personal care, food, and beverage. Berry primarily serves stable, consumer-oriented end markets and is headquartered in Evansville, Indiana, the US.

In October 2022, Berry and PYLOTE announced a partnership to introduce a new ophthalmic dropper featuring a unique multidose design that combines high-barrier properties with unique antimicrobial protection.

Mondi Group specializes in providing paper and packaging solutions, manufacturing and supplying pulp, paper, and flexible plastic packaging products. Its diverse portfolio includes packaging paper, consumer packaging products, uncoated fine paper, and specialty items. Additionally, the company is involved in forest management and the conversion of packaging papers into industrial bags and specialty extrusion-coated solutions. Mondi's products serve a wide range of industries, including automotive, medical and pharmaceutical, retail, pet care, construction, chemicals, e-commerce, beverages, home and personal care, agriculture, office supplies, printing, transportation, and food.

With operations spanning the Americas, Europe, Africa, and Asia, Mondi is headquartered in Weybridge, England, UK.

In April Mondi partnered with Thimonnier to introduce a new recyclable mono-material berlingot sachet designed for liquid soap refills. This innovative packaging solution significantly reduces plastic usage by more than 75% compared to rigid plastic bottles.