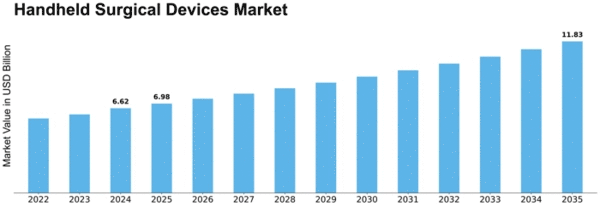

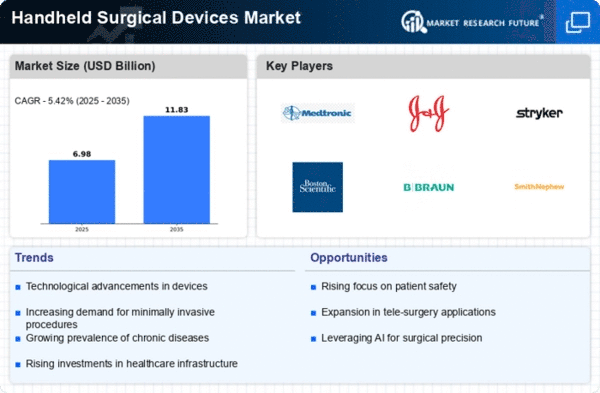

Handheld Surgical Devices Size

Handheld Surgical Devices Market Growth Projections and Opportunities

The rising interest for insignificantly intrusive medical procedures is a key variable shaping the handheld surgical devices market. As patients and medical care suppliers favor methodology with more modest entry points, handheld devices that work with negligibly intrusive procedures, for example, laparoscopy and endoscopy, experience developing interest. The market is impacted by the rising pattern of mobile or short-term surgical techniques. Handheld surgical devices assume a pivotal part in methodology led external usual clinic settings, adding to the productivity of surgical intercessions. The maturing segment is a huge calculate the handheld surgical devices market. With a rising older population, there is an expanded frequency age related medical issues that require surgical mediation. Handheld devices, intended for accuracy and usability, take care of the necessities of this segment. The predominance of ongoing infections, for example, cardiovascular illnesses and muscular circumstances, impacts the handheld surgical devices market. Surgical mediations are in many cases vital in the management of these circumstances, and handheld devices offer accuracy and adaptability in tending to different medical care needs. The market is molded by the interest for practical and compact surgical arrangements. Handheld devices, offering portability and diminished framework prerequisites, appeal to medical services offices looking for productive and monetarily feasible surgical choices. The combination of mechanical technology and artificial intelligence (AI) in handheld surgical devices is a prominent market pattern. Canny highlights improve gadget practicality, considering more exact and robotized surgical techniques, adding to the market's mechanical development. The market is affected through training and instruction drives for medical care experts. Expertise advancement programs and instructive campaigns add to the more extensive reception of handheld surgical devices, as trained experts are better prepared to successfully use these devices.

Leave a Comment