Handheld Counter Ied Size

Handheld Counter IED Market Growth Projections and Opportunities

The Handheld Counter IED (Improvised Explosive Device) market is experiencing notable growth, influenced by key market factors that define its landscape. One of the primary drivers fueling this market is the persistent threat of improvised explosive devices in various conflict zones and regions facing security challenges. As terrorist organizations and insurgent groups continue to employ improvised explosive devices, there is a growing demand for handheld counter-IED devices to enhance the capabilities of military and security forces in detecting and neutralizing these threats.

Technological advancements in counter-IED solutions are crucial in shaping the trajectory of the Handheld Counter IED market. Ongoing innovations focus on developing portable and user-friendly devices equipped with advanced sensors, detection technologies, and communication capabilities. Handheld counter-IED devices are designed to provide rapid and accurate identification of explosive materials and components, aiding in the timely response to potential threats. The integration of artificial intelligence and data analytics further enhances the efficiency and reliability of these devices, contributing to their effectiveness in the field.

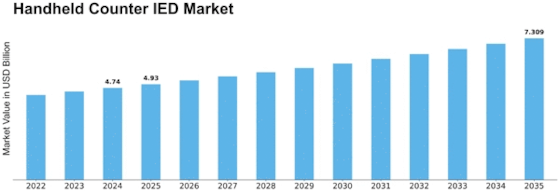

The anticipated CAGR for the Global Handheld Counter IED Market during the forecast period is 2.74%. These portable devices, held in the user's hand, primarily incorporate technologies like ground-penetrating radar.

Regulatory considerations play a significant role in influencing the Handheld Counter IED market. Governments and defense agencies worldwide implement regulations and standards to ensure the safety, reliability, and interoperability of counter-IED devices. Compliance with these regulations is crucial for manufacturers, shaping the design, testing, and deployment of handheld counter-IED solutions. Adherence to established standards ensures that these devices meet the necessary criteria for effective threat detection and response, contributing to the overall security objectives.

The competitive landscape of the Handheld Counter IED market is characterized by the presence of specialized manufacturers and suppliers. Collaboration and partnerships between manufacturers and defense organizations are common strategies to develop and deliver cutting-edge counter-IED technologies. Intense competition stimulates continuous innovation, leading to the introduction of advanced features, improved ergonomics, and enhanced detection capabilities in handheld devices. The market's evolution is further driven by the quest for more versatile, portable, and reliable solutions in countering the evolving nature of IED threats.

Economic factors, including defense budgets and the global security environment, significantly impact the dynamics of the Handheld Counter IED market. Investments in defense and security technologies influence the procurement decisions of military and law enforcement agencies. The affordability and cost-effectiveness of handheld counter-IED devices are key considerations, particularly during periods of budget constraints. The market's growth is often correlated with increased defense spending and the recognition of counter-IED capabilities as essential components of national security strategies.

Geopolitical considerations and regional security challenges also influence the Handheld Counter IED market. Regions facing elevated threats of terrorism and insurgency drive the demand for advanced counter-IED solutions. Military and security forces in these areas prioritize the acquisition of handheld devices capable of rapidly identifying and neutralizing explosive threats, contributing to the market's expansion. The adaptability of these devices to different operational environments further enhances their appeal in addressing diverse security challenges.

Leave a Comment