- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

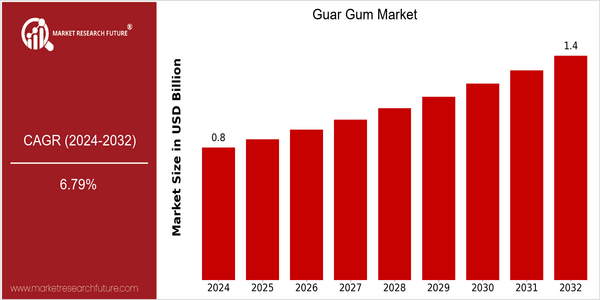

Guar Gum Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 0.81 Billion |

| 2032 | USD 1.37 Billion |

| CAGR (2024-2032) | 6.79 % |

Note – Market size depicts the revenue generated over the financial year

Guar gum is a natural gum, which has been used for a long time in the food and drug industry. Guar gum is a product of the seed of the guar tree. Guar gum is an important gum in the food and drug industry. Guar gum is an important gum in the food and drug industry. The Guar gum market was worth $ 810 million in 2024 and is expected to reach $ 1,368 million by 2032, at a CAGR of 6.76% for the period of forecast. Guar gum is gaining popularity in many industries, especially in food, pharmaceuticals and cosmetics, where its thickening and stabilizing properties are highly valued. Guar gum is also finding increasing application in the oil and gas industry, where hydraulic fracturing has regained momentum due to fluctuating energy prices and technological advancements in extraction methods. Guar gum is used as a viscosity modifier in oil drilling muds. The main players in the Guar gum market are Ashland Global Holdings Inc., Hindustan Gum & Chemicals Ltd. and Vikas WSP Ltd., who are constantly engaged in strategic activities to benefit from this growth. They are investing in research and development to enhance the quality of their products and expand their applications, and forming alliances to increase their market share. Recent product launches have focused on high-purity guar gum varieties, which meet the specific needs of the pharmaceutical industry. Guar gum is a natural product, which is sustainable and can be used in many industries. As the demand for sustainable and versatile ingredients increases, the Guar gum market will continue to grow in the coming years.

Regional Deep Dive

Guar gum market is a market that has experienced a dynamic growth in recent years, driven by the rising demand for food, pharmaceutical, and industrial applications. North America's market is characterized by a strong focus on natural and organic products, while Europe is characterized by a strong focus on regulatory compliance and sustainable development. India, a major producer and exporter of guar gum, continues to be the largest producer and exporter of guar gum. The Middle East and Africa are experiencing a boom in food and beverage industries, and Latin America is gradually introducing guar gum into various applications, resulting in a wide range of market drivers and opportunities.

North America

- Guar gum is a natural thickener that is gaining popularity in the food and beverage industries. The trend toward clean labeling is boosting demand for guar gum, with DuPont and Ingredion among the leading suppliers.

- Recent regulatory changes, including the FDA’s approval of guar gum as a safe food additive, have further increased the use of this gum in the food industry and encouraged product innovation.

- Hence, the manufacturers are prompted by the sustainable-development movement to find a more eco-friendly way of obtaining guar gum, and agro-institutions like the Trust for Sustainable Food and Farming are advocating the responsible cultivation of this material.

Europe

- The European market is increasingly demanding that its products be made more sustainable. The European Commission, for example, is promoting the use of natural additives such as guar gum to reduce the dependence on synthetic food additives.

- The pharmaceutical industry, in particular in drug formulations, has pushed guar gum to the forefront of its development.

- Regulations such as the EU’s Food Additives Directive are shaping the market by ensuring that only safe and approved substances are used, thereby enhancing consumers’ trust.

Asia-Pacific

- Guar gum is the most important product of the Indian industry. The Indian gum companies have made a large investment in guar gum processing.

- Guar gum is used as a stabilizer and thickener, mainly in dairy and bakery products.

- The government is planning to increase the agricultural production and exports in the country, which will strengthen the guar gum industry in the region.

MEA

- During the last decade, the food industry in the Middle East has grown considerably, and the companies such as Almarai and Nestlé have been investing in products that make use of guar gum for stability and texture.

- In recent years the regulating authorities of the Middle East have been adopting international standards of hygiene, which is reflected in the increasing demand for food additives, such as guar gum.

- The demand for natural products in the food industry has been influenced by a cultural preference for natural ingredients in foods. Guar gum fits in well with the trend for healthier products.

Latin America

- Guar gum is slowly establishing itself in the Latin American market. In Brazil and Argentina it is already being added to many food products.

- The new collaboration between food companies and agricultural cooperatives has encouraged the cultivation of guar beans, strengthening the local supply chain.

- Regulations promoting the use of natural food additives have facilitated the widespread use of guar gum in different applications.

Did You Know?

“Guar gum is a gum extracted from the seeds of the guar tree, which is ten times more concentrated than other natural gums, and so is a very effective thickener.” — International Journal of Food Science & Technology

Segmental Market Size

The guar gum market is characterized by its steady growth, which is mainly driven by the food and beverage, pharmaceutical, and cosmetics industries. The main driving force for the guar gum market is the increasing demand for natural and clean-label products. Also, regulatory authorities have favored the use of natural ingredients over synthetic ones, which has benefited the guar gum market.

The use of guar gum is now in its advanced stage, and the industry is largely in the hands of the companies Ashland and Hindustan Gum & Chemicals. In regions such as North America and Europe, where the demand for organic and gluten-free products is increasing, these companies have been able to take the lead. Their main applications are in gluten-free baked goods, dairy products, and pharmaceuticals. The growing demand for organic and gluten-free products is being driven by the growing popularity of plant-based diets, and the demand for natural products is also rising. Extraction and processing techniques are being developed to keep up with this trend.

Future Outlook

The Guar Gum Market is set to show a remarkable growth from 2024 to 2032, with a CAGR of 6.71% from $800 million to $1,368 million. This growth will be mainly driven by the growing demand for natural and organic food products and the increasing applications of guar gum in various industries, including food, pharmaceuticals, and cosmetics. Guar gum is set to gain a larger market share in the food industry as consumers are increasingly becoming more conscious about clean labeling. Guar gum is expected to account for a share of 15–20% in the gluten-free and vegetarian food market by 2032.

The market is driven by technological developments and policy drivers. In the future, innovations in extraction and processing are expected to improve the quality and yield of guar gum, which will make it more accessible and profitable for manufacturers. Moreover, the government's encouragement of sustainable agriculture and the use of natural additives will also promote market growth. Also, the use of guar gum in hydraulic fracturing and other industrial applications will increase. Guar gum has a strong growth potential and is well positioned to take advantage of the growing focus on sustainable development.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 0.75 billion |

| Growth Rate | 6.79% (2024-2032) |

Guar Gum Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.