Grp Pipes Size

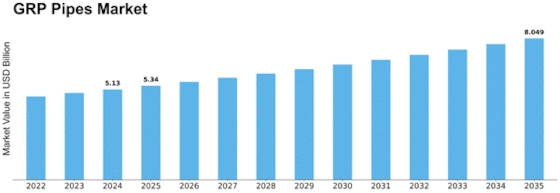

GRP Pipes Market Growth Projections and Opportunities

The GRP (Glass Reinforced Plastic) Pipes market is subject to a range of market factors that collectively influence its dynamics. One prominent driver is the increasing demand for corrosion-resistant and lightweight materials in various industries. GRP pipes offer exceptional resistance to corrosion, making them an ideal choice for applications in sectors such as chemical processing, oil and gas, and water infrastructure. Their lightweight nature not only simplifies transportation and installation but also contributes to overall cost-effectiveness.

Glass Reinforced Plastic (GRP) Pipes Market reinforcements are incorporated in cured thermosetting polymers. Because of their anti-corrosion qualities, GRP is becoming more popular in the GRP Pipes Industry. The GRP Pipes Market Share is expanding as the petroleum sector expands, as well as its good utility for moving chemicals, a global focus on public utilities, and for delivering water for irrigation purposes.

Environmental considerations also contribute significantly to the GRP Pipes market dynamics. As sustainability becomes a central focus in construction and infrastructure projects, GRP pipes gain popularity due to their eco-friendly characteristics. They are known for their long lifespan, reducing the need for frequent replacements and minimizing environmental impact. Additionally, the manufacturing process of GRP pipes often involves the use of recyclable materials, aligning with global efforts to promote green and sustainable construction practices.

Urbanization and population growth play a pivotal role in influencing the GRP Pipes market. The rapid expansion of urban areas requires robust and durable infrastructure, and GRP pipes fulfill this need by offering resistance to both chemical corrosion and physical wear. The versatility of these pipes makes them suitable for various applications, including sewerage systems, water distribution, and industrial pipelines, contributing to their demand in urban development projects.

Economic factors, including GDP growth, infrastructure investments, and industrial development, significantly impact the GRP Pipes market. Periods of economic growth often coincide with increased infrastructure spending, leading to higher demand for construction materials like GRP pipes. Conversely, economic downturns may result in a slowdown in construction and infrastructure projects, affecting the market negatively.

Government regulations and policies also play a crucial role in shaping the GRP Pipes market. Many governments worldwide are implementing standards and regulations to ensure the use of durable and corrosion-resistant materials in critical infrastructure projects. GRP pipes, with their ability to withstand harsh environmental conditions, often meet or exceed these regulatory requirements, positioning them favorably in the market. Government initiatives promoting water conservation and sustainable infrastructure further contribute to the demand for GRP pipes.

Technological advancements are integral to the GRP Pipes market. Continuous innovations in manufacturing processes, such as improved resin formulations and enhanced curing methods, contribute to the production of high-quality GRP pipes. Advanced design and installation technologies also enhance the performance and efficiency of these pipes, making them more appealing to industries with specific engineering requirements.

Global trends, such as the emphasis on water conservation and the development of smart cities, impact the GRP Pipes market. The need for efficient water distribution systems and sustainable infrastructure aligns with the characteristics of GRP pipes. The pipes' ability to resist corrosion, reduce leakage, and offer long-term durability makes them suitable for addressing the challenges posed by water scarcity and the development of modern urban landscapes.

Market competition and the presence of key players are additional factors shaping the GRP Pipes market. The industry's competitive landscape encourages research and development efforts, leading to the introduction of new and improved GRP pipe products. Key players often focus on expanding their product portfolios, improving manufacturing processes, and engaging in strategic collaborations to maintain a competitive edge in the market.

Leave a Comment