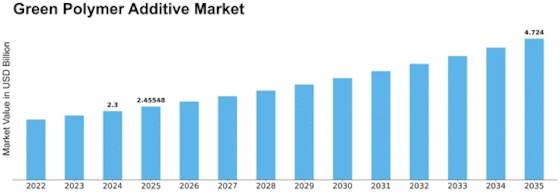

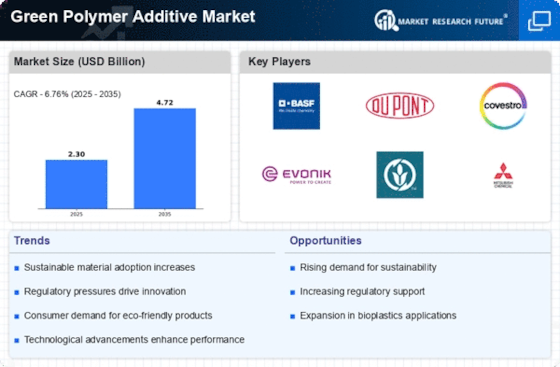

Green Polymer Additive Size

Green Polymer Additive Market Growth Projections and Opportunities

The polymer industry’s growing concern for environmental impact is one of the major forces driving the market for Green Polymer Additives. To make polymer-based products more sustainable, Green polymer additives are part of the solution and are increasingly gaining popularity as they work towards eco-friendly practices in the world. Such sectors as packaging, automotive and construction are driving a need for Green Polymer Additives due to increasing environmental concerns. These chemicals become vital in finding environmentally friendly materials that last longer.

Green Polymer Additive sector is very much concerned with environmental issues and regulatory requirements. As essential ingredients in polymer compositions with high ecological standards, these additives must be regulated to comply with both safety and sustainability laws. If manufacturers want to satisfy regulators and align themselves with what environmentally conscious industries expect, then they have to pay attention to these directives. In their response to customer interest on green products, companies strive to produce Green Polymer Additives that can biodegrade easily in nature without causing any harm.

The economic situation significantly affects the Green Polymer Additive market.. Their demand grows tremendously during macroeconomic situations such as legislative stimuli promoting sustainable practices, preference for eco-friendly products by customers or general need for green substances.. Demand for green polymers goes up when there is an economic boom since most people adopt sustainable practices.. Conversely, an economic slump affects particular industries adversely resulting into unfavourable market dynamics.

One thing that helps develop this field considerably is the advancement in additive formulation technology. By making them more ecologically-friendly; compatible with various types of polymers and improved overall performance modern development technologies have made Green Polymer Additives more adaptable and useful than ever before. For companies seeking first mover advantage within the industry; investing time in research &development activities will help them keep pace with changing trends within this niche market.

For instance availability of raw materials at a given price point determines how prices of goods incorporating green polymer additives behave at any given time within the year. In these additives, natural polymers, bio-based feedstocks and other eco-friendly sources are often used as the main ingredients. The overall production cost as well as market dynamics is influenced by fluctuations in their prices. A consistent and efficient supply chain is needed in order to stabilize the market and ensure continuous availability of Green Polymer Additives to end-users.

Again, many global trade policies and geopolitical considerations affect the Green Polymer Additive Market. International trade agreements, tariffs and geo-political conflicts could affect the supply and demand of sustainable materials. Therefore, for market participants to effectively manage global trade dynamics they must navigate through such external forces.

The competitive dynamics of the Green Polymer Additive industry are affected by key participants, market share and strategic initiatives. When they seek to make a place for themselves in the market, many companies opt for product innovation, broadening their offerings of Green Polymer Additives and forging links with other entities. The environmental-friendly additive sector which includes Green Polymer Additives is dynamic therefore firms often utilize mergers and acquisitions as means to strengthen their positions and gain an edge.

Leave a Comment