Market Trends

Key Emerging Trends in the Green Data Center Market

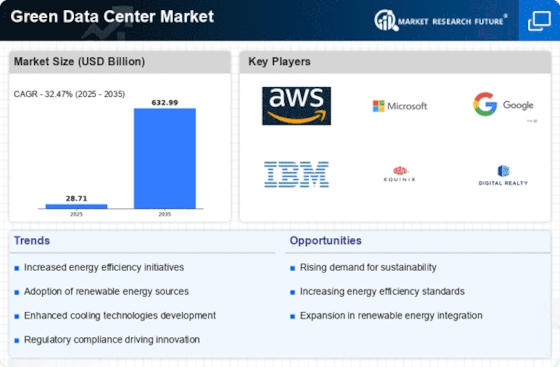

As the meaning of maintainability in the innovation area develops, the market patterns in green data center area show an eminent advancement. The rising utilization of environmentally friendly power sources is one significant pattern. With an end goal to turn out to be less subject to regular power networks, green server farms are moving their energy sources from petroleum products to sustainable ones like sun oriented and wind. This change assists organizations with turning out to be more energy free and less reliant upon energy cost swings, as well as being in accordance with natural objectives. An extra imperative advancement is the emphasis on energy-effective plans. Inventive plans are turning out to be increasingly more famous as server farms keep on focusing on energy effectiveness.

The use of energy-productive equipment, modern power conveyance procedures, and fluid cooling frameworks all add to the general adequacy of green data center. By decreasing working expenses, this pattern assists organizations with setting aside cash while at the same time tending to ecological worries. The possibility of roundabout economy strategies is additionally affecting the improvements in the green data center market. To make a shut circle framework, this involves limiting waste, reutilizing materials, and reusing parts. Server farm framework fashioners and administrators are focusing on making durable, effectively upgradeable, and recyclable plans. This pattern upholds the general goal of empowering a more supportable lifecycle for the server farm hardware and bringing down electronic waste. Measured server farm arrangements are turning out to be increasingly more well known as a significant pattern in light of the developing necessity for adaptability and versatility.

On account of these particular plans' speedy organization and development abilities, organizations can undoubtedly scale the server farm framework to meet their evolving needs. The particular methodology decreases superfluous power utilization by permitting parts to be taken out or added in light of interest, which further develops adaptability while likewise further developing energy effectiveness. Green data center market patterns are additionally being affected by cloud and edge registering. The ubiquity of such registering models has expanded interest for geologically scattered server farms that are close to end clients. This example diminishes idleness and further develops information handling effectiveness all around. Via cautiously setting their structures to work with cloud and edge processing, green data center is acclimating to this pattern and reducing the natural impact of significant distance information transmission. The utilization of AI and ML in data center is a conspicuous pattern.

Proactive checking, the prescient support, and ideal asset distribution are made conceivable by these innovations, which raise functional viability and lower energy utilization. Ongoing information investigation by artificial intelligence and ML calculations can find regions for energy reserve funds and improve the overall presentation of the green data center. Solid safety efforts are turning out to be more normal in the green data center as security worries in the advanced circle develop. High level security conventions are being executed by server farms to safeguard classified information and assure the trustworthiness of the activities. To shield against evolving dangers, this incorporates encryption innovations, biometric access controls, and broad online protection measures. Regardless, there are still issues with the market patterns for green data center. For specific associations, the underlying capital expense important to embrace green innovations keeps on being an obstruction. Defeating this hindrance requires convincing partners of long-haul benefits and profit from venture. Moreover, it is hard to decently contrast and evaluate different arrangements due with the shortfall of standard measurements for checking the ecological presentation of the green data center.

Leave a Comment