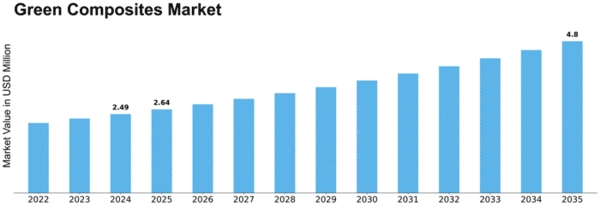

Green Composites Size

Green Composites Market Growth Projections and Opportunities

The Green Composites market has forces that influence it from different corners, which is a combination that drives the emphasis on sustainability and eco-friendly materials. The increased use of certain sectors in the economy, such as car manufacturing, building, and packaging, has seen an increase in demand for green composites. Green composites are commonly made from natural fibers like cellulose or are derived from renewable substances like starch. In the Green Composites market, regulatory considerations and sustainability goals are important aspects. These green composites, therefore, contribute to global efforts aimed at cutting down pollution due to industrial activities. Regulatory standards on sustainable development coupled with carbon output controls also influence the decision to adopt green composites across different industries where they have been used by manufacturers if there is a need to meet mandatory regulations and satisfy a growing number of environmentally minded buyers. A critical driver for the Green Composites market is global economics. Economic factors, including industrial production, construction activity, and consumer preferences, directly determine how many green composite materials consumers will demand. During periods of economic growth, there is usually an increased focus on environmentalism among companies and consumer preference for eco-friendly products; hence, demand for green composites surges and then comes down when recession sets in. Technological advancements have had a great impact on how this industry evolves through the innovative development of composite formulations. Innovations in processing technologies, reinforcement materials, and bio-based resins can improve performance characteristics such as strength properties, allowing greater flexibility to be incorporated into these types of material systems than ever before using sustainable feedstocks, resulting in new generations of high-quality environmentally friendlier composite materials that outperform its traditional counterpart thus boosting its inherent utilization capabilities within a wide range applications. Those firms leveraging R&D investments so that they stay ahead in technological changes position themselves well to address dynamic consumer interests better than others, hence remaining competitive amid other businesses operating within the Green Composites sector. Raw material availability and pricing are some of the supply chain dynamics that affect the Green Composites market. The major raw materials for green composites are often natural fibers such as jute, hemp, or flax and bio-based resins, including corn starch or soy oil-based products. Other factors that influence the Green Composites market are global trade policies and geopolitical conditions. This is because tariffs, trade agreements, and political conflicts can restrict the flow of these raw materials in international markets, thereby affecting their demand and supply equilibrium. In order to thrive in this environment, companies must adapt to such externalities while also learning how to deal with them so as to conduct a successful business in a global marketplace. Major players influence competition within the Green Composites market by controlling market share through strategic initiatives they undertake. Companies do well when they focus on product innovation; they enhance the range of products available in the marketplace through things like entering into partnerships.

Leave a Comment