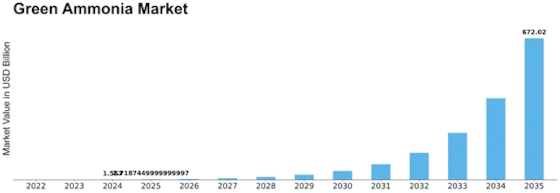

Green Ammonia Size

Green Ammonia Market Growth Projections and Opportunities

The market factors influencing the Green Ammonia market are multifaceted, driven by a combination of environmental concerns, technological advancements, regulatory frameworks, and economic dynamics. At the forefront of these factors is the growing global awareness of the detrimental effects of conventional ammonia production methods on the environment, particularly in terms of greenhouse gas emissions. As a result, there's a mounting pressure on industries to transition towards more sustainable practices, spurring the demand for green alternatives like green ammonia.

Technological innovations play a pivotal role in shaping the market dynamics of green ammonia. Breakthroughs in renewable energy sources, such as wind and solar power, have significantly enhanced the feasibility and cost-effectiveness of green ammonia production. These advancements have bolstered investor confidence and spurred investments in green ammonia infrastructure, driving market growth.

Moreover, regulatory initiatives aimed at curbing carbon emissions and promoting renewable energy adoption have created a favorable regulatory environment for green ammonia producers. Governments around the world are implementing policies and incentives to incentivize the adoption of green technologies, further fueling the market expansion. These regulatory measures include carbon pricing mechanisms, renewable energy mandates, and subsidies for green ammonia production.

Another key factor influencing the green ammonia market is the shifting dynamics of the global energy landscape. With increasing volatility in fossil fuel markets and growing concerns over energy security, there's a growing impetus to diversify energy sources and reduce dependence on traditional fuels. Green ammonia offers a promising solution, serving as a versatile energy carrier for applications such as fuel cells, power generation, and as a feedstock for chemical synthesis.

Furthermore, the economics of green ammonia production are becoming increasingly favorable compared to conventional methods. As the cost of renewable energy continues to decline and economies of scale are realized in green ammonia production, the cost competitiveness of green ammonia is improving. This trend is attracting both traditional ammonia producers seeking to diversify their portfolios and new entrants looking to capitalize on the growing demand for sustainable alternatives.

Market factors related to supply chain logistics and infrastructure development also play a crucial role in shaping the green ammonia market. Investments in ammonia production facilities, storage infrastructure, and transportation networks are essential to meet the growing demand for green ammonia and ensure its widespread adoption across various industries. Moreover, collaborations and partnerships along the value chain are essential to drive innovation, optimize processes, and reduce costs, further bolstering market growth.

Leave a Comment