Top Industry Leaders in the GPON Technology Market

Competitive Landscape of GPON Technology Market

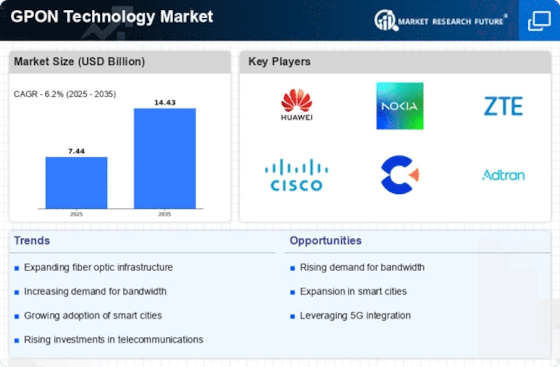

The Gigabit Passive Optical Network (GPON) technology market is experiencing a surge in demand, driven by the insatiable appetite for faster broadband, the rise of 5G networks, and the expansion of FTTH (Fiber-to-the-Home) infrastructure. As a result, the competitive landscape is becoming increasingly dynamic, with established players jostling for market share and new entrants seeking to disrupt the status quo.

Key Players:

- Nokia

- Fiberhome

- ZTE

- Calix

- Huawei

- Cisco

- DASAN Zhone

- Allied Telesis

- Iskratel

- NEC

- Alphion

- Unizyx

- ADTRAN

Strategies Adopted by Key Players:

- Tier-1 Giants: Huawei, ZTE, and NEC dominate the market with their extensive product portfolios, strong brand recognition, and global reach. Their strategies often revolve around cost-effective solutions, aggressive pricing, and government partnerships in emerging markets.

- Established Players: Companies like ADTRAN, Calix, and Nokia hold strong positions in North America and Europe. They focus on high-performance, reliable equipment, tailored solutions for specific applications, and robust customer support.

- Emerging Players: Altiostar, Innolight, and Xtera are making waves with innovative offerings like SDN-enabled GPON solutions, advanced encryption technologies, and next-generation PON variants like XGS-PON and NG-PON2. Their agility and focus on niche markets give them an edge.

Factors for Market Share Analysis:

- Market Share: Understanding the current market share of key players is crucial. Tracking their growth trajectories and regional dominance provides valuable insights into their strengths and weaknesses.

- Product Portfolio: Analysing the breadth and depth of each player's product portfolio is essential. Offering a diverse range of solutions for residential, business, and enterprise applications caters to a wider audience.

- Technological Advancements: Investing in R&D and staying ahead of the curve with next-generation technologies like XGS-PON and NG-PON2 is critical for long-term success.

- Geographical Presence: Having a strong global presence and the ability to adapt to regional regulations and requirements is advantageous in capturing market share in diverse geographies.

- Pricing Strategies: Competitive pricing is crucial in this cost-sensitive market. However, offering value-added services and differentiating through features can command premium pricing.

New and Emerging Companies:

The influx of new entrants like Altiostar, Innolight, and Xtera is bringing fresh ideas and innovative solutions to the market. Their focus on SDN-enabled networks, advanced security features, and next-generation PON variants is shaking up the established order. These companies are also targeting niche markets underserved by traditional players, creating unique growth opportunities.

Current Company Investment Trends:

- Focus on Next-Generation PON: Leading players are investing heavily in developing and deploying XGS-PON and NG-PON2 technologies to cater to the growing demand for higher bandwidth and ultra-low latency.

- Software-Defined Networks (SDN): Integrating SDN capabilities into GPON solutions is gaining traction, enabling network programmability and flexible management of network resources.

- Security and Encryption: As cyber threats evolve, companies are prioritizing robust data encryption and security features in their GPON equipment.

- Fiber-to-the-Premises (FTTP): The transition from FTTH to FTTP is gaining momentum, prompting players to expand their offerings and adapt to the changing network architecture.

Latest Company Updates:

The largest fiber-to-the-home (FTTH) operator in South Africa, Vuma, stated in 2023 that it will be bringing next-generation fibre innovation and technology to the market through a recent agreement with Huawei. The ITU-T defines the 50G PON as a next-generation PON technology that efficiently enables 10Gbps Everywhere.

The first wholesale 2.5 Gbps symmetrical consumer broadband service in the nation was introduced in 2023 by CityFibre, the full-fibre infrastructure provider in the United Kingdom. According to the corporation, millions of homeowners in the UK would now be able to access inexpensive multi-gigabit internet connections as of this announcement.

With the debut of the Digisol XPON ONU 1200 Mbps Wi-Fi Router with 1 PON, 2 GE Ports, and 1 FXS Port (DG-GR6821AC), DIGISOL Systems Ltd., a leading supplier of Trusted Made in India Products and IT Networking Solutions, will be adding more products to its Made in India product portfolio in 2022. The recently released GR6821AC is an XPON ONU 1200 Mbps Dual Band Wireless Router intended to provide SOHO customers with FTTH triple play services.

At the Mobile World Congress (MWC) in 2023, ZTE Corporation introduced a 50G PON & 10G GPON & GPON three-mode Combo PON product solution. The solution uses the same ODN and platform and has an independent wavelength stacking mechanism to handle three generations of PON technologies (GPON, 10G PON, and 50G PON). solves issues with high construction costs, occupying large spaces in central offices, complicated optical fibre cabling, and challenging operations and maintenance during the transition from GPON to 10G GPON and subsequently to 50G PON. It also assists operators in quickly and flexibly providing high-bandwidth services, streamlining network construction, and cutting costs associated with deployment.