Expansion of Electronics Sector

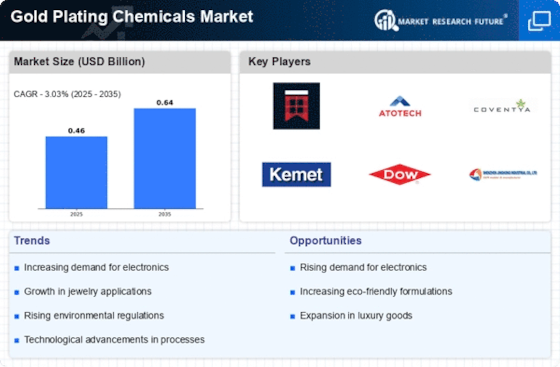

The expansion of the electronics sector is a pivotal driver for the Gold Plating Chemicals Market. With the increasing integration of gold plating in electronic components, such as connectors and circuit boards, the demand for gold plating chemicals is on the rise. In 2025, the electronics industry is anticipated to contribute significantly to the overall market growth, as manufacturers seek to enhance the conductivity and corrosion resistance of their products. The trend towards miniaturization in electronics further necessitates the use of gold plating, as it provides a reliable solution for high-performance applications. Consequently, the growth of the electronics sector is likely to bolster the demand for gold plating chemicals, reinforcing their importance in the Gold Plating Chemicals Market.

Rising Consumer Awareness of Quality

Rising consumer awareness regarding product quality is influencing the Gold Plating Chemicals Market. As consumers become more discerning, they increasingly seek products that not only look appealing but also offer durability and longevity. This trend is particularly evident in the jewelry and electronics sectors, where the quality of gold plating can significantly impact consumer satisfaction. In 2025, manufacturers are expected to prioritize the use of high-quality gold plating chemicals to meet these evolving consumer expectations. This shift towards quality assurance is likely to drive innovation and competition within the market, as companies strive to differentiate their offerings. Thus, the heightened focus on quality serves as a crucial driver for the Gold Plating Chemicals Market.

Increasing Demand in Jewelry Manufacturing

The Gold Plating Chemicals Market is experiencing a notable surge in demand due to the growing popularity of gold-plated jewelry. As consumers increasingly favor affordable luxury items, manufacturers are responding by utilizing gold plating chemicals to enhance the aesthetic appeal of their products. In 2025, the jewelry sector is projected to account for a significant portion of the market, driven by consumer preferences for gold-plated accessories. This trend is further supported by the rise of e-commerce platforms, which facilitate access to a broader audience. Consequently, the demand for high-quality gold plating chemicals is likely to increase, as manufacturers seek to meet consumer expectations for durability and finish. The expansion of the jewelry market thus serves as a critical driver for the Gold Plating Chemicals Market.

Regulatory Support for Sustainable Practices

Regulatory support for sustainable practices is emerging as a key driver for the Gold Plating Chemicals Market. Governments and regulatory bodies are increasingly promoting the use of environmentally friendly chemicals in manufacturing processes. This trend is particularly relevant in the context of gold plating, where traditional chemicals may pose environmental risks. In 2025, the market is likely to see a shift towards the adoption of sustainable gold plating chemicals, driven by both regulatory requirements and consumer preferences for eco-friendly products. As manufacturers adapt to these regulations, the demand for innovative and sustainable gold plating solutions is expected to grow. This regulatory landscape thus plays a significant role in shaping the future of the Gold Plating Chemicals Market.

Technological Innovations in Plating Processes

Technological advancements in plating processes are transforming the Gold Plating Chemicals Market. Innovations such as electroplating and chemical vapor deposition are enhancing the efficiency and quality of gold plating applications. These technologies allow for more precise control over the thickness and uniformity of gold layers, which is essential for various industries, including electronics and automotive. As manufacturers adopt these advanced techniques, the demand for specialized gold plating chemicals is expected to rise. In 2025, the market is likely to witness an increase in the adoption of eco-friendly chemicals, aligning with sustainability goals. This shift towards innovative plating technologies not only improves product quality but also drives growth within the Gold Plating Chemicals Market.