-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- CONSUMPTION & NET TRADE APPROACH

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TECHNIQUE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- RISING DEMAND FOR GOLD JEWELRY

- CENTRAL BANK RESERVES

-

RESTRAINTS

- ENVIRONMENTAL AND REGULATORY CONSTRAINTS

- RESOURCE DEPLETION & LOWER ORE GRADES

-

OPPORTUNITY

- UNTAPPED RESERVES IN DEVELOPING REGIONS

- RISING INVESTMENT DEMAND

-

IMPACT ANALYSIS OF COVID-19

- IMPACT ON SUPPLY

- IMPACT ON DEMAND

-

IMPACT ANALYSIS OF RUSSIA-UKRAINE WAR

-

MARKET FACTOR ANALYSIS

-

SUPPLY/VALUE CHAIN ANALYSIS

- UPSTREAM (EXPLORATION & EXTRACTION)

- MIDSTREAM (PROCESSING & REFINING)

- DOWNSTREAM (DISTRIBUTION & END USE)

-

PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

PRICING ANALYSIS, BY REGION USD/OZ (2019-2035)

-

SUPPLY-DEMAND ANALYSIS

-

BROAD LEVEL GAP ANALYSIS TO UNDERSTAND UNTAPPED AREAS

- BASED ON PROCESS

- BASED ON END USE

-

TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS

- TECHNOLOGY ROADMAP

- COMPATIBILITY WITH APPLICATIONS

- ADVANCED TESTING AND ANALYSIS

-

R&D UPDATE

- CURRENT SCENARIO

- FUTURE ROADMAP

- CHALLENGES

- NOVEL APPLICATIONS

- KEY DEVELOPMENTS

-

CASE STUDIES/USE CASES

- CASE STUDY 1: NEWMONT’S AUTONOMOUS HAULAGE SYSTEM (NEVADA GOLD MINES, USA)

- CASE STUDY 2: AGNICO EAGLE’S MELIADINE MINE – ARCTIC MINING WITH ESG FOCUS (NUNAVUT, CANADA)

-

PESTLE ANALYSIS

-

GLOBAL GOLD MINING MARKET, BY PROCESS

-

INTRODUCTION

- PLACER MINING

- HARDROCK MINING

- OTHERS

-

GLOBAL GOLD MINING MARKET, BY END USE

-

INTRODUCTION

- INVESTMENT

- JEWELRY

- ELECTRO-CHEMICAL

-

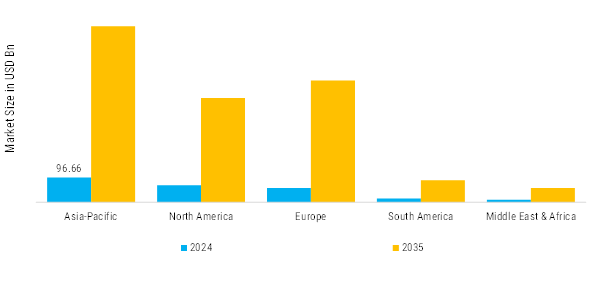

GLOBAL GOLD MINING MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- FRANCE

- SPAIN

- SWEDEN

- RUSSIA

- REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- INDONESIA

- REST OF ASIA PACIFIC

-

MIDDLE EAST & AFRICA

- IRAN

- TURKEY

- SOUTH AFRICA

- GHANA

- ZIMBABWE

- BURKINA FASO

- COLOMBIA

- TANZANIA

- REST OF MIDDLE EAST & AFRICA

-

SOUTH AMERICA

- CHILE

- PERU

- ARGENTINA

- REST OF SOUTH AMERICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

COMPANY MARKET SHARE ANALYSIS, 2024

-

COMPETITION DASHBOARD

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- ACQUISITION/AGREEMENT

- EXPANSION

- PRODUCT LAUNCH/DEVELOPMENT

-

COMPANY PROFILE

-

GOLD FIELDS LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

AGNICO EAGLE MINES LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

BARRICK GOLD CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

POLYUS GOLD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

NEWMONT MINING CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

KINROSS GOLD CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

ANGLOGOLD ASHANTI LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

EVOLUTION MINING LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

NORTHERN STAR RESOURCES LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

HARMONY GOLD MINING COMPANY LIMITED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

DATA CITATIONS

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

GLOBAL GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

GLOBAL GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

GLOBAL GOLD MINING MARKET, BY END USE, 2019-2035 (USD BILLION)

-

GLOBAL GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

GLOBAL GOLD MINING MARKET, BY REGION, 2019-2035 (USD BILLION)

-

GLOBAL GOLD MINING MARKET, BY REGION, 2019-2035 (TONS)

-

NORTH AMERICA: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

NORTH AMERICA: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (TONS)

-

NORTH AMERICA: GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

NORTH AMERICA: GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

NORTH AMERICA GOLD MINING MARKET, BY END USE, 2019-2035 (USD BILLION)

-

NORTH AMERICA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

US: GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

US: GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

US GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

US GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

CANADA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

CANADA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

CANADA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

CANADA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

MEXICO GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

MEXICO GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

MEXICO GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

MEXICO GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

EUROPE: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

EUROPE: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (TONS)

-

EUROPE GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

EUROPE GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

EUROPE GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

EUROPE GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

FRANCE GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

FRANCE GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

FRANCE GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

FRANCE GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

SPAIN GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

SPAIN GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

SPAIN GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

SPAIN GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

SWEDEN GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

SWEDEN GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

SWEDEN GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

SWEDEN GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

RUSSIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

RUSSIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

RUSSIA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

RUSSIA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

REST OF EUROPE GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

REST OF EUROPE GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

REST OF EUROPE GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

REST OF EUROPE GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

ASIA PACIFIC: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

ASIA PACIFIC: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (TONS)

-

ASIA PACIFIC GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

ASIA PACIFIC GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

ASIA PACIFIC GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

ASIA PACIFIC GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

CHINA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

CHINA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

CHINA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

CHINA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

INDIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

INDIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

INDIA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

INDIA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

JAPAN GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

JAPAN GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

JAPAN GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

JAPAN GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

SOUTH KOREA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

SOUTH KOREA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

SOUTH KOREA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

SOUTH KOREA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

AUSTRALIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

AUSTRALIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

AUSTRALIA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

AUSTRALIA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

INDONESIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

INDONESIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

INDONESIA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

INDONESIA GOLD MINING MARKET, BY END USE, 2019-2035 (TONS)

-

REST OF ASIA PACIFIC GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC GOLD MINING MARKET, BY PROCESS, 2019-2035 (TONS)

-

REST OF ASIA PACIFIC GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

REST OF ASIA PACIFIC GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

MIDDLE EAST & AFRICA: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (TONS)

-

MIDDLE EAST & AFRICA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

MIDDLE EAST & AFRICA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

MIDDLE EAST & AFRICA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

IRAN GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

IRAN GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

IRAN GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

IRAN GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

TURKEY GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

TURKEY GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

TURKEY GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

TURKEY GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

SOUTH AFRICA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

SOUTH AFRICA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

SOUTH AFRICA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

SOUTH AFRICA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

GHANA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

GHANA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

GHANA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

GHANA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

ZIMBABWE GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

ZIMBABWE GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

ZIMBABWE GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

ZIMBABWE GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

BURKINA FASO GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

BURKINA FASO GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

BURKINA FASO GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

BURKINA FASO GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

COLOMBIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

COLOMBIA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

COLOMBIA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

COLOMBIA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

TANZANIA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

TANZANIA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

TANZANIA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

TANZANIA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

REST OF MIDDLE EAST & AFRICA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

REST OF MIDDLE EAST & AFRICA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

REST OF MIDDLE EAST & AFRICA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

SOUTH AMERICA: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (USD BILLION)

-

SOUTH AMERICA: GOLD MINING MARKET, BY COUNTRY, 2019-2035 (TONS)

-

SOUTH AMERICA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

SOUTH AMERICA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

SOUTH AMERICA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

SOUTH AMERICA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

BRAZIL GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

BRAZIL GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

BRAZIL GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

BRAZIL GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

CHILE GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

CHILE GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

CHILE GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

CHILE GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

PERU GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

PERU GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

PERU GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

PERU GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

ARGENTINA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

ARGENTINA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

ARGENTINA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

ARGENTINA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

REST OF SOUTH AMERICA GOLD MINING MARKET, BY PROCESS, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA GOLD MARKET, BY PROCESS, 2019-2035 (TONS)

-

REST OF SOUTH AMERICA GOLD MARKET, BY END USE, 2019-2035 (USD BILLION)

-

REST OF SOUTH AMERICA GOLD MARKET, BY END USE, 2019-2035 (TONS)

-

COMPETITION DASHBOARD: EUROPE AND SOUTH AMERICA TRANSFORMER STATION MARKET

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

ACQUISITION/AGREEMENT

-

EXPANSION

-

PRODUCT LAUNCH/DEVELOPMENT

-

GOLD FIELDS LTD: PRODUCTS OFFERED

-

GOLD FIELDS LTD: KEY DEVELOPMENTS

-

AGNICO EAGLE MINES LTD: PRODUCTS OFFERED

-

AGNICO EAGLE MINES LTD: KEY DEVELOPMENTS

-

BARRICK GOLD CORPORATION: PRODUCTS OFFERED

-

BARRICK GOLD CORPORATION: KEY DEVELOPMENTS

-

POLYUS GOLD: PRODUCTS OFFERED

-

NEWMONT MINING CORPORATION: PRODUCTS OFFERED

-

KINROSS GOLD CORPORATION: PRODUCTS OFFERED

-

ANGLOGOLD ASHANTI LTD: PRODUCTS OFFERED

-

EVOLUTION MINING LTD: PRODUCTS OFFERED

-

NORTHERN STAR RESOURCES LTD: PRODUCTS OFFERED

-

HARMONY GOLD MINING COMPANY LIMITED: PRODUCTS OFFERED

-

LIST OF FIGURES

-

GLOBAL GOLD MINING MARKET (BY REGION), 2024

-

GLOBAL GOLD MINING MARKET SNAPSHOT, 2024

-

GLOBAL GOLD MINING MARKET: STRUCTURE

-

GLOBAL GOLD MINING MARKET: MARKET GROWTH FACTOR ANALYSIS (2019-2035)

-

TOP 5 COUNTRIES/REGIONS BY JEWELRY DEMAND IN 2024

-

2024: GOLD RESERVES (TONNES), BY COUNTRY

-

YEAR-WISE EXPECTATIONS OF GLOBAL CENTRAL BANKS ON GOLD RESERVE CHANGES (2019–2025)

-

2024: GOLD RESERVES (TONNES), BY REGION

-

2024: GOLD RESERVES (TONNES), BY REGION

-

DRIVERS IMPACT ANALYSIS (2025-2035)

-

RESTRAINT IMPACT ANALYSIS (2025-2035)

-

AFRICA'S GOLD MINING PRODUCTION VOLUMES, BY COUNTRY 2024 IN TONNES

-

GOLD DEMAND IN INVESTEMENT SECTOR, TONNES 2023 VS 2024

-

SUPPLY CHAIN: GLOBAL GOLD MINING MARKET

-

PORTER'S FIVE FORCES ANALYSIS OF THE GOLD MINING MARKET

-

PORTER'S FIVE FORCES ANALYSIS OF THE GOLD MINING MARKET

-

GLOBAL GOLD MINING MARKET, BY PROCESS, 2024 (% SHARE)

-

GLOBAL GOLD MINING MARKET, BY END USE, 2024 (% SHARE)

-

GLOBAL GOLD MINING MARKET, BY REGION, 2024 (% SHARE)

-

NORTH AMERICA: GOLD MINING MARKET SHARE, BY COUNTRY, 2024 (% SHARE)

-

EUROPE AND SOUTH AMERICA TRANSFORMER STATION MARKET SHARE ANALYSIS, 2024 (%)

-

GOLD FIELDS LTD: FINANCIAL OVERVIEW SNAPSHOT

-

GOLD FIELDS LTD: SWOT ANALYSIS

-

AGNICO EAGLE MINES LTD: FINANCIAL OVERVIEW

-

AGNICO EAGLE MINES LTD: SWOT ANALYSIS

-

BARRICK GOLD CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

BARRICK GOLD CORPORATION: SWOT ANALYSIS

-

POLYUS GOLD: SWOT ANALYSIS

-

NEWMONT MINING CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

NEWMONT MINING CORPORATION: SWOT ANALYSIS

-

KINROSS GOLD CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

KINROSS GOLD CORPORATION: SWOT ANALYSIS

-

ANGLOGOLD ASHANTI LTD: FINANCIAL OVERVIEW SNAPSHOT

-

ANGLOGOLD ASHANTI LTD: SWOT ANALYSIS

-

EVOLUTION MINING LTD: FINANCIAL OVERVIEW SNAPSHOT

-

EVOLUTION MINING LTD: SWOT ANALYSIS

-

NORTHERN STAR RESOURCES LTD: FINANCIAL OVERVIEW SNAPSHOT

-

NORTHERN STAR RESOURCES LTD: SWOT ANALYSIS

-

HARMONY GOLD MINING COMPANY LIMITED: FINANCIAL OVERVIEW SNAPSHOT

-

HARMONY GOLD MINING COMPANY LIMITED: SWOT ANALYSIS

Leave a Comment