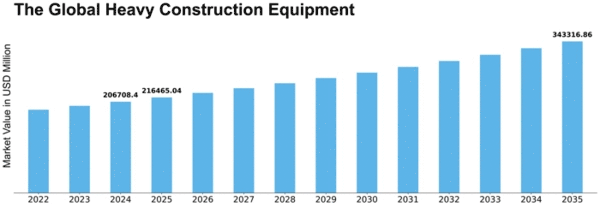

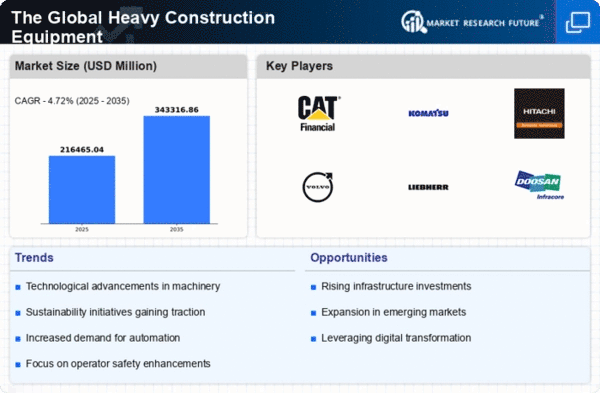

Global Heavy Construction Equipment Size

Global Heavy Construction Equipment Market Growth Projections and Opportunities

Many variables influence the heavy construction equipment market, which in turn affects its growth, trends, and overall performance. The following is a list of the major market variables in pointer format: Boom in Infrastructure Development and Construction: Roads, bridges, airports, and urban construction are examples of infrastructure development projects that have a direct impact on the market for heavy construction equipment. The increase in building due to urbanization and population growth has a direct effect on the need for heavy machinery. Situation of the World Economy: Interest rates, government spending, GDP growth, and other economic factors have a big impact on the heavy construction equipment industry. The construction industry may slow down during economic downturns, which would impact equipment demand. Equipment Technological Advancements: Continuous technological developments, such as automation, telematics, and GPS tracking, increase the effectiveness and capacities. The use of technology drives consumer trends and draws in customers seeking out cutting-edge, effective equipment solutions. Growth in the Rental industry: The dynamics of the industry are being impacted by the increasing trend of renting construction equipment rather than buying it completely. Construction enterprises benefit from flexibility offered by rental choices, particularly during periods of economic fluctuations. Environmental Rules and Guidelines for Emissions: The market for equipment with reduced emissions and increased fuel efficiency is driven by stricter environmental rules and emission standards. Adoption and development of new equipment models are influenced by compliance with environmental regulations. Demand from the Mining and Extractive Industries: For material handling, excavation, and transportation, the mining and extractive industries mostly depend on heavy construction equipment. The requirement for specialized heavy equipment in mining operations is influenced by the demand for minerals and raw materials around the world. Government Infrastructure Investments: The market for heavy construction equipment is stimulated by government initiatives and investments in infrastructure projects. Market patterns are significantly influenced by infrastructure spending, which includes long-term development plans and stimulus packages. Trends in the Global Rental of Construction Equipment: Due to budgetary constraints and project-specific requirements, equipment rental services are becoming more and more popular, which has an effect on consumer behavior. The kinds and models of equipment that manufacturers offer are influenced by rental patterns.

Leave a Comment