E-commerce Growth

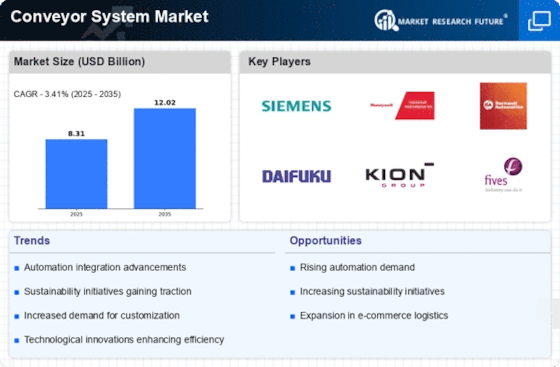

The Conveyor System Market is significantly influenced by the rapid expansion of e-commerce. With online shopping becoming increasingly prevalent, logistics and warehousing operations are under pressure to optimize their supply chains. The e-commerce sector is expected to grow at a rate of around 14% annually, necessitating efficient material handling solutions. Conveyor systems play a crucial role in automating the sorting, packing, and shipping processes, thereby enhancing delivery speed and accuracy. As retailers seek to meet consumer demands for faster shipping, the reliance on conveyor systems is likely to intensify. This trend not only boosts the Conveyor System Market but also encourages innovation in system design and functionality to accommodate the unique challenges posed by e-commerce logistics.

Sustainability Initiatives

Sustainability initiatives are becoming a pivotal driver in the Conveyor System Market. As organizations strive to reduce their carbon footprint, there is a growing demand for eco-friendly conveyor systems. Manufacturers are increasingly focusing on developing energy-efficient systems that utilize sustainable materials and reduce waste. The market for green technologies is projected to expand, with energy-efficient conveyor systems expected to gain traction. This shift towards sustainability not only aligns with corporate social responsibility goals but also appeals to environmentally conscious consumers. As companies adopt greener practices, the Conveyor System Market is likely to evolve, fostering innovation in sustainable design and manufacturing processes.

Technological Advancements

Technological advancements are a driving force in the Conveyor System Market, as innovations in materials and design lead to more efficient and durable systems. The introduction of smart conveyor systems equipped with sensors and IoT capabilities allows for real-time monitoring and predictive maintenance. This technological evolution is expected to enhance system reliability and reduce downtime, which is critical for industries that rely on continuous operations. Furthermore, advancements in automation technologies, such as robotics and artificial intelligence, are likely to integrate seamlessly with conveyor systems, creating more sophisticated material handling solutions. As these technologies continue to evolve, they will likely reshape the Conveyor System Market, fostering a competitive landscape that prioritizes efficiency and adaptability.

Rising Demand for Automation

The Conveyor System Market is experiencing a notable surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and food processing are increasingly adopting automated conveyor systems to enhance operational efficiency. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This trend indicates a shift towards more streamlined processes, reducing labor costs and minimizing human error. As companies strive for higher productivity, the integration of conveyor systems becomes essential, thereby driving growth in the Conveyor System Market. Furthermore, the need for real-time monitoring and data analytics in production lines is likely to propel the adoption of advanced conveyor technologies.

Increased Focus on Safety Standards

The Conveyor System Market is witnessing a heightened emphasis on safety standards and regulations. As industries become more aware of workplace safety, the demand for conveyor systems that comply with stringent safety guidelines is on the rise. Regulatory bodies are continuously updating safety protocols, which necessitates the incorporation of safety features in conveyor designs. This trend is particularly evident in sectors such as manufacturing and food processing, where the risk of accidents can have severe consequences. Companies are increasingly investing in conveyor systems that not only enhance productivity but also prioritize employee safety. This focus on safety is likely to drive innovation within the Conveyor System Market, as manufacturers strive to develop systems that meet or exceed regulatory requirements.