Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are positively impacting the orthopedic devices market in Germany. The German government has allocated substantial funding to enhance medical facilities and promote research in orthopedic technologies. For instance, the Federal Ministry of Health has introduced programs to support innovation in medical devices, which includes orthopedic solutions. This financial backing is expected to stimulate the development of new products and technologies, potentially increasing market growth by an estimated 15% over the next five years. Such initiatives not only enhance patient care but also encourage manufacturers to invest in the orthopedic devices market.

Technological Integration in Healthcare

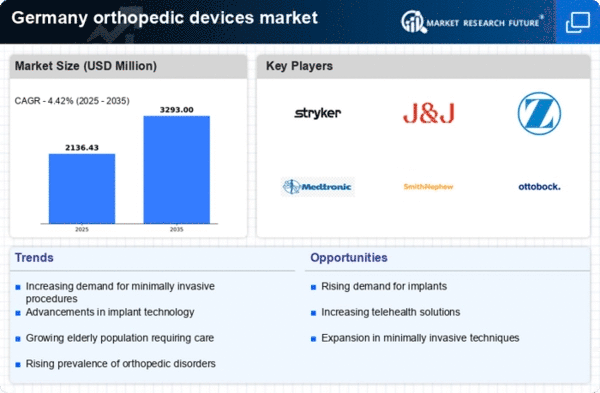

The integration of advanced technologies in healthcare is transforming the orthopedic devices market in Germany. Innovations such as 3D printing, robotics, and telemedicine are enhancing the design, production, and delivery of orthopedic devices. For example, 3D printing allows for the customization of implants and prosthetics, improving patient outcomes and satisfaction. Furthermore, the use of robotic-assisted surgeries is increasing, which can lead to shorter recovery times and reduced complications. As these technologies become more prevalent, the orthopedic devices market is expected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 10% over the next few years.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare measures among the German population, which is influencing the orthopedic devices market. Individuals are increasingly seeking solutions to prevent injuries and manage existing conditions proactively. This shift in mindset is leading to a higher demand for orthopedic devices that support preventive care, such as orthotic devices and ergonomic supports. Health campaigns and educational programs are promoting the importance of maintaining musculoskeletal health, which could potentially increase market penetration by 20% in the coming years. As consumers become more health-conscious, the orthopedic devices market is likely to adapt to these changing preferences.

Increased Sports Participation and Injuries

The growing interest in sports and physical activities among the German population is contributing to a rise in sports-related injuries, thereby boosting the orthopedic devices market. With more individuals engaging in recreational and competitive sports, the incidence of injuries such as fractures, ligament tears, and tendon injuries is on the rise. Reports indicate that sports injuries account for nearly 30% of all orthopedic cases in Germany. This trend necessitates the development and availability of specialized orthopedic devices, including braces, supports, and surgical implants, to cater to the needs of athletes and active individuals. As a result, the orthopedic devices market is likely to expand to meet this demand.

Rising Incidence of Musculoskeletal Disorders

The orthopedic devices market in Germany is experiencing growth due to the increasing prevalence of musculoskeletal disorders. Conditions such as osteoarthritis and rheumatoid arthritis are becoming more common, particularly among the aging population. According to recent data, approximately 20% of the German population suffers from some form of musculoskeletal disorder, leading to a heightened demand for orthopedic devices. This trend is likely to continue as the population ages, with projections indicating that by 2030, the number of individuals over 65 years will rise significantly. Consequently, healthcare providers are investing in advanced orthopedic solutions to address these challenges, thereby driving the orthopedic devices market.