Increased Disposable Income

The rise in disposable income among German consumers is significantly impacting the manuka honey market. As individuals have more financial flexibility, they are more inclined to invest in premium health products, including manuka honey. Market analysis suggests that the premium segment of the manuka honey market has seen a surge, with sales increasing by 20% in the last year alone. This trend indicates that consumers are willing to pay higher prices for quality products that offer perceived health benefits. Consequently, the manuka honey market is likely to expand as more consumers prioritize health and wellness in their purchasing decisions, leading to a broader acceptance of premium-priced honey.

Expansion of Retail Channels

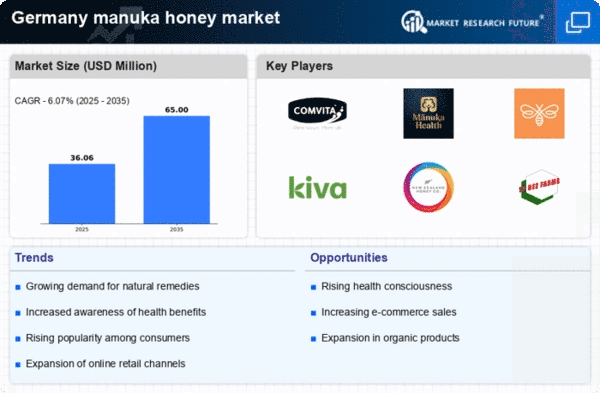

The expansion of retail channels is playing a crucial role in the growth of the manuka honey market. In Germany, the availability of manuka honey in various retail formats, including supermarkets, health food stores, and online platforms, is increasing. This diversification of distribution channels enhances consumer access to manuka honey products, thereby driving sales. Recent statistics show that online sales of manuka honey have surged by 30% in the last year, indicating a shift in shopping habits. The manuka honey market is likely to benefit from this trend as more consumers discover and purchase manuka honey through convenient retail options, further solidifying its market presence.

Growing Demand for Natural Products

The growing demand for natural and organic products is a significant driver for the manuka honey market. In Germany, consumers are increasingly seeking alternatives to processed foods, favoring products that are perceived as pure and unadulterated. This trend is evident in the manuka honey market, where organic certifications and natural sourcing are becoming essential selling points. Recent data indicates that organic manuka honey sales have increased by 25% over the past year, reflecting a shift in consumer preferences. The manuka honey market is thus adapting to these demands by emphasizing natural production methods and sustainability, which resonate with environmentally conscious consumers.

Rising Awareness of Health Benefits

The increasing awareness of the health benefits associated with manuka honey is a pivotal driver in the manuka honey market. Consumers in Germany are becoming more informed about the antibacterial and anti-inflammatory properties of manuka honey, which are attributed to its unique compounds like methylglyoxal (MGO). This heightened awareness is reflected in market data, indicating a growth rate of approximately 15% in sales over the past year. As health-conscious consumers seek natural remedies, the demand for manuka honey continues to rise, positioning it as a preferred choice among alternative sweeteners. The manuka honey market is thus experiencing a shift towards products that promote wellness, further solidifying its place in the health food sector.

Influence of Social Media and Marketing

The influence of social media and targeted marketing strategies is significantly shaping the manuka honey market. In Germany, brands are leveraging social media platforms to educate consumers about the benefits of manuka honey, creating a buzz around its uses and applications. This marketing approach appears to resonate well with younger demographics, who are more likely to engage with health trends online. Data suggests that brands utilizing social media marketing have experienced a 40% increase in brand awareness and consumer engagement. Consequently, the manuka honey market is adapting its strategies to harness the power of digital marketing, which is likely to enhance brand loyalty and drive sales.