Increased Focus on Quality Control

Quality control remains a critical aspect of the life science-analytical-instruments market in Germany. As regulatory bodies impose stricter guidelines on product quality and safety, companies are compelled to adopt advanced analytical techniques to comply with these standards. The demand for instruments that can provide accurate and reproducible results is on the rise, particularly in pharmaceutical and biotechnology sectors. The market for quality control instruments is projected to grow by approximately 6% annually, driven by the need for compliance with Good Manufacturing Practices (GMP) and other regulatory requirements. This trend underscores the importance of reliable analytical tools in maintaining product integrity within the life science-analytical-instruments market.

Emergence of Advanced Data Analytics

The integration of advanced data analytics into laboratory processes is transforming the life science-analytical-instruments market in Germany. As laboratories increasingly adopt data-driven approaches, the demand for instruments that can generate and analyze large datasets is growing. This trend is particularly relevant in fields such as genomics and proteomics, where complex data interpretation is essential. The market for analytical instruments equipped with data analytics capabilities is expected to expand significantly, with a projected growth rate of 7% over the next few years. This shift towards data-centric methodologies highlights the evolving landscape of the life science-analytical-instruments market, where the ability to harness data effectively is becoming a competitive advantage.

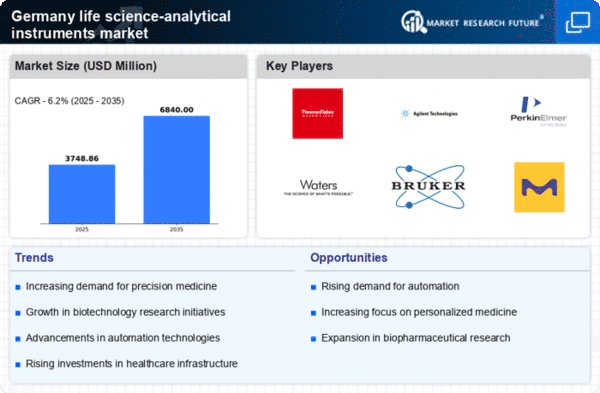

Rising Demand for Precision Medicine

The life science-analytical-instruments market in Germany is experiencing a notable increase in demand for precision medicine. This trend is driven by the growing recognition of personalized healthcare solutions that cater to individual patient needs. As healthcare providers and researchers seek to develop targeted therapies, the need for advanced analytical instruments becomes paramount. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the increasing investment in research and development. Furthermore, the integration of genomics and proteomics into clinical practice necessitates sophisticated analytical tools, thereby propelling the demand for high-quality instruments in the life science-analytical-instruments market.

Expansion of Biopharmaceutical Sector

Germany's biopharmaceutical sector is expanding rapidly, significantly impacting the life science-analytical-instruments market. The country is home to numerous biopharma companies that are investing heavily in research and development to create innovative therapies. This expansion is expected to drive the demand for analytical instruments that can support complex bioprocessing and quality control. In 2025, the biopharmaceutical market in Germany is anticipated to reach €50 billion, which will likely necessitate advanced analytical solutions for drug development and manufacturing. Consequently, the life science-analytical-instruments market is poised to benefit from this growth, as companies seek reliable and efficient tools to ensure product safety and efficacy.

Investment in Research and Development

Investment in research and development (R&D) is a key driver of growth in the life science-analytical-instruments market in Germany. The government and private sector are increasingly funding R&D initiatives aimed at advancing scientific knowledge and technological innovation. This influx of capital is likely to enhance the development of new analytical instruments that meet the evolving needs of researchers and clinicians. In 2025, R&D spending in the life sciences is projected to exceed €10 billion, which will likely stimulate demand for cutting-edge analytical tools. As a result, the life science-analytical-instruments market is expected to thrive, driven by the continuous pursuit of innovation and excellence in scientific research.