Geofoam Size

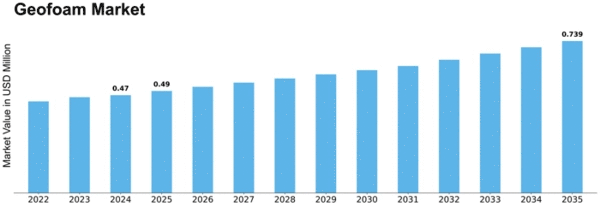

Geofoam Market Growth Projections and Opportunities

There is a wide range of factors that affect how the Geofoam market performs in terms of its dynamics and growth. One of the most important drivers of this market is the growing need for lightweight construction materials by manufactures from different industries. As a result, Geofoam has become an attractive alternative to traditional building materials because it has a lower density but high tensile strength. It also reduces the structural weight, while ensuring durability, making it very attractive for infrastructure projects including roads, bridges and embankment.

The second important factor contributing towards growth in Geofoam market is global construction sector enlargement. With urbanization going at a fast pace, there is demand for improved ways that can make it possible to construct faster and with lesser costs incurred. Contractors prefer using Geofoams due to their ease of handling, versatility as well as fixing simplicity during construction process leading to low cost and fast execution time. Moreover, it acts as insulator within geotechnical engineering or environmental applications.

Environmental concerns are another major driver of development in the Geofoam industry. In environmentally conscious world where governments are focusing on sustainable practices such kind of material like Geofoam comes handy because it fits perfectly into any scenario. Its recyclability and less impact on environment imitate the trend towards green building materials. Therefore, various countries’ governments worldwide are encouraging adoption of eco-friendly policies which enhances demand for geo-foil.

Other market dynamics include technological advancement in material sciences. These efforts are being made continuously to improve performance features of geo-film thereby making it easily adaptable to variety uses. Such new production methods along with modified composition contribute towards its future expansion into geotechnical engineering among others.

The economic situation and trends in investment in construction largely impact the Geofoam industry today. Economic growth coupled with increased spending on infrastructure boosts demand for construction materials.Economical and efficient use of resources makes these materials popular among contract managers and engineers in charge of the projects aimed at optimization budget without compromising on a high level of quality.

Nonetheless, there are challenges facing the Geofoams market. Key considerations for the companies that operate in this market include changing costs of inputs which can have an impact on overall cost of production. In addition, awareness creation and education among construction industry stakeholders about advantages and usage of Geofoam into the market is key. This has been done through educating project decision makers, engineers and architects on various applications of Geofoams leading to wider acceptance by contractors using it during construction.

Leave a Comment