Market Growth Projections

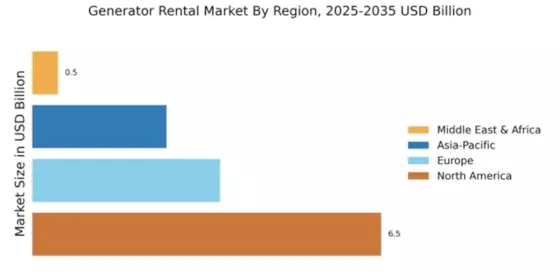

The Global Generator Rental Market Industry is poised for substantial growth, with projections indicating a market size of 7.09 USD Billion in 2024 and an anticipated increase to 12.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.21% from 2025 to 2035, reflecting the increasing reliance on rental generators across various sectors. The market's expansion is likely driven by factors such as infrastructure development, technological advancements, and the growing need for temporary power solutions.

Adoption of Renewable Energy Sources

The Global Generator Rental Market Industry is witnessing a shift towards renewable energy sources, which, paradoxically, increases the demand for backup generators. As organizations invest in solar and wind energy, the need for reliable backup power during periods of low generation becomes critical. Rental generators provide a flexible solution for businesses transitioning to renewable energy, allowing them to maintain operations without significant upfront investments. This trend suggests a potential growth trajectory for the market, as companies seek to balance sustainability with reliability in power supply.

Growth in Infrastructure Development

Infrastructure development remains a pivotal driver for the Global Generator Rental Market Industry. Governments worldwide are investing heavily in infrastructure projects, such as roads, bridges, and airports, which necessitate substantial power supply for construction activities. The increasing number of infrastructure projects, particularly in emerging economies, fuels the demand for rental generators. This trend is expected to contribute to the market's growth, with projections indicating a rise to 12.4 USD Billion by 2035, as more contractors opt for rental solutions to manage costs and enhance operational efficiency.

Rising Awareness of Disaster Preparedness

The Global Generator Rental Market Industry benefits from an increasing awareness of disaster preparedness among businesses and communities. Natural disasters and unforeseen events necessitate reliable power sources to ensure safety and continuity. Organizations are increasingly recognizing the importance of having contingency plans that include rental generators as a viable solution for maintaining operations during emergencies. This heightened awareness is expected to drive demand, as more entities invest in rental services to safeguard against power disruptions, thereby enhancing the overall market outlook.

Increasing Demand for Temporary Power Solutions

The Global Generator Rental Market Industry experiences a surge in demand for temporary power solutions across various sectors, including construction, events, and emergency services. This trend is driven by the need for reliable power sources during outages or in remote locations. For instance, construction projects often require generators to ensure uninterrupted operations, particularly in areas lacking stable electricity. As a result, the market is projected to reach 7.09 USD Billion in 2024, reflecting a growing reliance on rental services to meet immediate power needs.

Technological Advancements in Generator Efficiency

Technological advancements play a crucial role in shaping the Global Generator Rental Market Industry. Innovations in generator design and efficiency lead to reduced fuel consumption and lower emissions, making rental options more appealing to environmentally conscious consumers. Enhanced monitoring systems and smart technology integration allow for real-time performance tracking and maintenance alerts, improving reliability and user experience. As these technologies evolve, they are likely to attract more businesses to rental solutions, thereby contributing to the market's anticipated growth rate of 5.21% from 2025 to 2035.