Market Analysis

In-depth Analysis of Gel Documentation Systems Market Industry Landscape

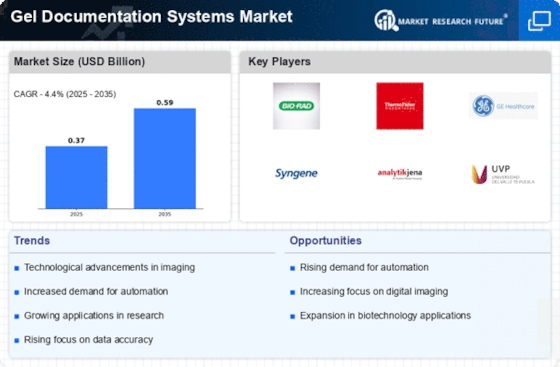

The Gel Documentation Systems market is a vital branch of the life sciences and biotechnology industry that experiences active fluctuations in its trends, which define the development of its market dynamics. The pivotal role played by these systems in molecular biology and biochemistry laboratories is to enable visualization and analysis of nucleic acid and protein samples separated through gel electrophoresis. Since 2022, there has been a constant demand for modernized systems that offer better sensitivity, resolution, as well as user-friendliness.

One important driver of the market dynamics is the increasing focus on genomics and proteomics R&D. The growing applications of gel documentation systems in DNA fingerprinting, genotyping, as well as protein analysis are creating a need for more sophisticated imaging solutions. In order to realize accurate, reproducible results for researchers and scientists, manufacturers have had to make investments in new products based on their requirements.

Furthermore, increased use of gel documentation systems in academic institutions and pharmaceutical establishments contributes to market dynamics. Such organizations have intensified their activities in molecular biology researches as well as drug discoveries thereby leading to demand for imaging devices which can enhance workflow efficiency. As a result, this trend promotes rivalry among industrial players who tend to develop integrated systems with user interfaces that are friendly easy but at the same time automated.

Technological aspects also come into play when analyzing market dynamics since they depict transition from analogues or traditional film-based techniques towards digital imaging systems.. These include replacing traditional film-based methods with digital detectors and cameras providing real-time visualization along with quantification. This shift not only leads to faster results but also aligns with the larger industry-wide push toward digitization and data integration. Consequently, companies investing in advanced technologies have an upper hand over competitors within this transforming landscape.

Globalization has also impacted the gel documentation systems’ market dynamics. Besides collaborative research programmes; several cross border partnerships have emerged calling for harmonized imaging approaches across different laboratory setups. This has resulted in heightened demand for gel documentation systems that are versatile and flexible enough to meet the diverse needs of various laboratories across the world.

Nevertheless, the existence of challenges such as high initial costs and requirements for trained personnel to operate them slightly hinder market dynamics. In response to this, market players have launched cost-effective products and training programs for their customers. Furthermore, there is also an introduction of smaller portable gel documentation systems which is being embraced a great deal providing a suitable option for small laboratories with limited budgets.”

Leave a Comment