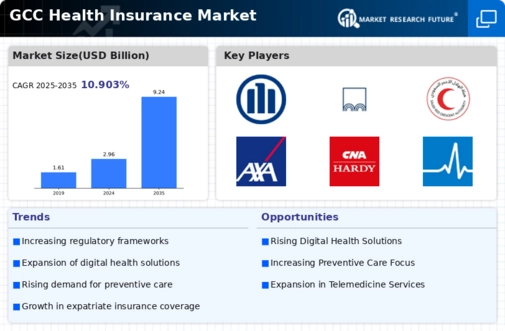

The GCC Health Insurance Market is a rapidly evolving sector characterized by intense competition and regulatory developments that shape the landscape for numerous providers. With an increasing focus on healthcare quality and accessibility, insurers are enhancing their product offerings to meet the diverse needs of the population. The market is distinguished by a blend of local players and international entrants, leading to innovations in service delivery, claims processing, and digital health solutions.

As the region witnesses a rise in health awareness and lifestyle-related illnesses, the demand for comprehensive health insurance plans continues to grow, prompting companies to adopt competitive strategies that emphasize customer-centric approaches and technological integration.Qatar Insurance Company has established itself as a formidable player in the GCC Health Insurance Market, leveraging its robust expertise and reputation. The company capitalizes on its extensive regional presence and a wide array of products tailored to meet specific customer needs. Strengths such as a strong capital base and a reputation for reliability enable Qatar Insurance Company to cater effectively to both individuals and corporates.

With a focus on innovative health insurance packages, including wellness programs and tailored group plans, the company has successfully positioned itself as a preferred provider in the market. Furthermore, its commitment to excellent customer service underpins its competitive advantage, creating strong customer loyalty and trust in an increasingly dynamic environment.Allianz Saudi Fransi holds a significant position within the GCC Health Insurance Market, known for its comprehensive suite of health insurance products and commitment to exceptional service standards.

The company offers a variety of services, including individual and family health plans, corporate health insurance packages, and specialized insurance solutions designed to meet the unique health needs of the Saudi population. With a strong focus on customer experience, Allianz Saudi Fransi utilizes technology to streamline operations and enhance the claims process for its clients. Its strategic presence in the GCC is strengthened by partnerships and collaborations, allowing the company to expand its reach effectively.

In recent years, Allianz Saudi Fransi has engaged in mergers and acquisitions to bolster its market position, facilitating the absorption of innovative practices and expanding its customer base. This proactive approach has allowed the company to maintain a competitive edge as it navigates the complexities of the regional healthcare landscape.

Leave a Comment