Rising Demand for Efficient Operations

The field service-management market is experiencing a notable surge in demand for operational efficiency across various sectors in the GCC. Companies are increasingly recognizing the need to streamline their service processes to reduce costs and enhance productivity. This trend is driven by the competitive landscape, where businesses strive to maintain a competitive edge. According to recent data, organizations that implement effective field service-management solutions can achieve up to 30% improvement in operational efficiency. This growing emphasis on efficiency is likely to propel the adoption of advanced technologies and software solutions within the field service-management market.

Growing Focus on Sustainability Practices

Sustainability is becoming a critical consideration for businesses operating in the field service-management market. Companies are increasingly adopting eco-friendly practices to meet regulatory requirements and consumer expectations. This shift is particularly evident in sectors such as utilities and telecommunications, where organizations are implementing green initiatives to reduce their carbon footprint. The GCC region is witnessing a rise in investments aimed at sustainable service solutions, which could potentially enhance brand reputation and customer loyalty. As sustainability becomes a priority, the field service-management market is likely to evolve, incorporating more environmentally friendly practices.

Increased Investment in Workforce Training

The field service-management market is seeing a heightened focus on workforce training and development. As the industry evolves with new technologies and methodologies, companies are investing in training programs to equip their employees with the necessary skills. This investment is crucial for maximizing the benefits of advanced field service-management solutions. Research indicates that organizations that prioritize workforce training can experience a 20% increase in service quality. Consequently, the emphasis on training is expected to drive growth in the field service-management market, as skilled personnel are essential for effective service delivery.

Technological Advancements in Service Delivery

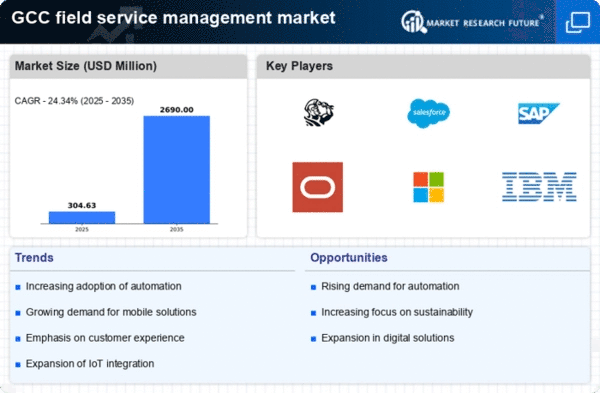

Technological innovations are playing a pivotal role in shaping the field service-management market in the GCC. The integration of IoT, cloud computing, and mobile applications is transforming how service providers manage their operations. These technologies enable real-time data access, enhancing decision-making and service delivery. For instance, the use of IoT devices allows for predictive maintenance, which can reduce downtime by up to 25%. As businesses increasingly adopt these technologies, the field service-management market is expected to witness substantial growth, driven by the need for improved service quality and operational agility.

Expansion of Service Offerings and Customization

The field service-management market is witnessing a trend towards the expansion of service offerings and customization. Companies are increasingly tailoring their services to meet the specific needs of their clients, which enhances customer satisfaction and loyalty. This trend is particularly relevant in sectors such as healthcare and manufacturing, where personalized service can lead to better outcomes. The ability to offer customized solutions is becoming a competitive differentiator, prompting businesses to invest in flexible service management systems. As a result, the field service-management market is likely to grow, driven by the demand for personalized and diverse service offerings.