Rising Security Concerns

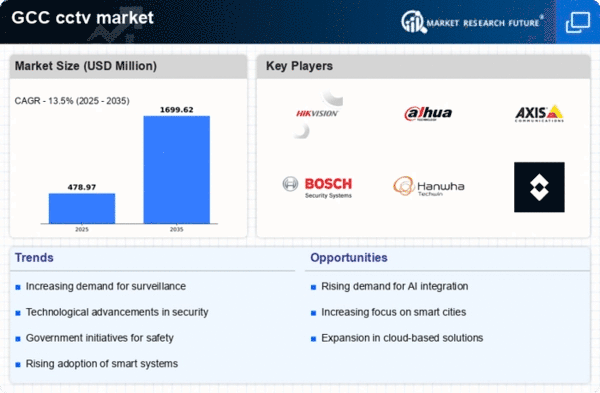

The increasing prevalence of crime and security threats in the GCC region has led to a heightened demand for surveillance solutions. As urbanization accelerates, cities are becoming more vulnerable to various security challenges. The cctv market is witnessing a surge in investments from both public and private sectors to enhance safety measures. In 2025, the market is projected to grow by approximately 15%, driven by the need for effective monitoring systems. Governments are also prioritizing public safety, which further propels the adoption of CCTV systems. This trend indicates that the cctv market is likely to expand as stakeholders recognize the importance of safeguarding assets and individuals.

Technological Innovations

The cctv market is experiencing rapid technological advancements that enhance the functionality and efficiency of surveillance systems. Innovations such as high-definition video, cloud storage, and artificial intelligence are transforming traditional CCTV systems into smart surveillance solutions. In the GCC, the integration of these technologies is expected to increase market growth by around 20% in the coming years. The ability to analyze data in real-time and improve image quality significantly contributes to the appeal of modern CCTV systems. As businesses and governments seek to leverage these advancements, the cctv market is poised for substantial growth, driven by the demand for cutting-edge security solutions.

Integration with IoT Solutions

The integration of Internet of Things (IoT) technologies into the cctv market is creating new opportunities for enhanced surveillance capabilities. IoT-enabled CCTV systems allow for remote monitoring and control, providing users with greater flexibility and responsiveness. In the GCC, this integration is expected to drive market growth by approximately 22% over the next few years. As businesses and governments seek to optimize their security measures, the demand for IoT-compatible CCTV solutions is likely to increase. This trend indicates a shift towards more interconnected and intelligent surveillance systems, positioning the cctv market for significant advancements.

Growing Demand from Retail Sector

The retail sector in the GCC is increasingly adopting CCTV systems to enhance security and improve operational efficiency. With the rise of e-commerce and changing consumer behaviors, brick-and-mortar stores are focusing on loss prevention and customer safety. The cctv market is likely to benefit from this trend, as retailers invest in advanced surveillance solutions to monitor customer interactions and deter theft. In 2025, the retail sector's contribution to the overall market is projected to reach 25%, indicating a robust demand for CCTV systems. This shift suggests that the cctv market will continue to evolve in response to the needs of the retail environment.

Government Initiatives and Investments

Government initiatives aimed at improving public safety and security are playing a crucial role in the growth of the cctv market in the GCC. Various countries in the region are investing heavily in surveillance infrastructure to combat crime and enhance safety. For instance, the UAE has allocated substantial budgets for smart city projects that include extensive CCTV networks. This trend is expected to contribute to a market growth rate of approximately 18% by 2026. Such investments not only bolster the cctv market but also create opportunities for local manufacturers and service providers to participate in these large-scale projects.