Gas Liquid Argon Size

Gas Liquid Argon Market Growth Projections and Opportunities

The Gas and Liquid Argon Market is influenced by several factors that collectively shape its trends and growth dynamics. One primary driver is the increasing demand for argon across various industries due to its diverse applications. Argon, an inert gas, finds extensive use in welding and metal fabrication, where it serves as a shielding gas to protect molten metals from atmospheric contamination. Additionally, argon is employed in the electronics industry for processes like plasma cutting, as well as in the medical field for cryopreservation and laser surgery. The versatility of argon contributes to its growing demand in multiple sectors.

Global economic conditions play a pivotal role in the Gas and Liquid Argon Market. Economic growth and industrialization contribute to increased manufacturing activities, fostering the need for gases like argon in welding, metal processing, and electronics manufacturing. Developing economies, undergoing rapid industrial expansion, significantly drive the market's growth as they become integral players in the global manufacturing landscape.

Technological advancements in gas separation and liquefaction processes impact the market dynamics. Ongoing research and development efforts lead to innovations that enhance the efficiency, purity, and cost-effectiveness of argon production. Companies that invest in these technological advancements gain a competitive edge by offering high-quality argon products that meet the stringent requirements of various industries.

The healthcare sector significantly contributes to the demand for argon in the Gas and Liquid Argon Market. Argon's applications in medical fields, such as cryopreservation and laser surgery, make it an essential gas in healthcare facilities. The medical industry's continuous growth and the need for advanced technologies contribute to the sustained demand for argon.

Environmental considerations and regulations also play a role in shaping the Gas and Liquid Argon Market. The production and use of argon, like any industrial gas, are subject to environmental regulations. Companies in the market must comply with environmental standards and adopt sustainable practices to address concerns related to gas emissions and environmental impact.

Geopolitical factors and trade dynamics further influence the Gas and Liquid Argon Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of argon. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Moreover, the metal fabrication and welding industry significantly contribute to the demand for argon. As these industries continue to evolve and adopt advanced welding technologies, the need for high-purity argon as a shielding gas remains paramount. Argon's inert properties make it suitable for protecting molten metals during welding processes, ensuring high-quality welds in various applications.

The electronics and semiconductor industry is another key driver of the Gas and Liquid Argon Market. Argon's role in plasma cutting and other semiconductor manufacturing processes, where a controlled atmosphere is crucial, contributes to its demand in this sector. As technology advances and electronic devices become more sophisticated, the demand for argon in electronics manufacturing is expected to grow.

Raw material prices, particularly those associated with air separation units and liquefaction processes, play a role in shaping the Gas and Liquid Argon Market. Fluctuations in energy prices and the costs of air separation gases impact the production costs and pricing of argon. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

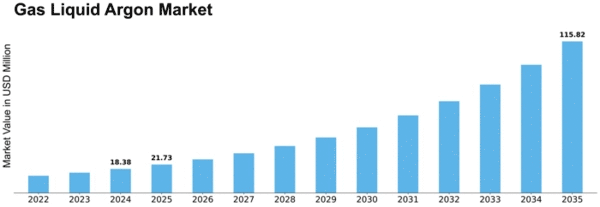

The global gas and liquid argon market is projected to expand at a healthy CAGR of 5.52% during the assessment period (2021-2028). The market is expected to reach a valuation of USD 475.3 million by the end of 2030.

Leave a Comment