-

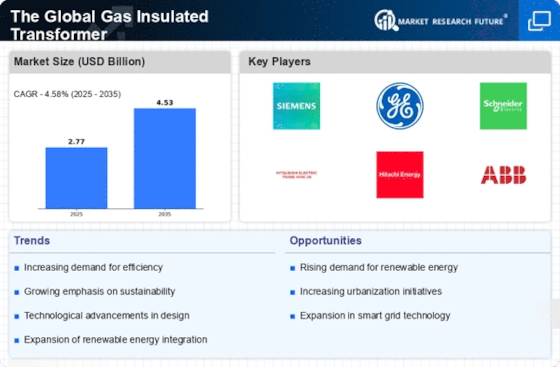

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Definition

- Research Objective

- Assumptions

- Limitations

-

Research Process

- Primary Research

- Secondary Research

-

Market size Estimation

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of substitutes

- Segment rivalry

-

Supply Chain Analysis

-

Market Dynamics

-

Introduction

-

Market Drivers

-

Market Restraints

-

Market Opportunities

-

Market Trends

-

Global Gas Insulated Transformer Market, By Type

-

Introduction

-

Instrument Transformer

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Others

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Gas Insulated Transformer Market, By Voltage Rating

-

Introduction

-

Medium Voltage

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

High Voltage

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Extra High Voltage

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Gas Insulated Transformer Market, By Installation

-

Introduction

-

Outdoor

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Indoor

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Gas Insulated Transformer Market, By End-User

-

Introduction

-

Utility

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Industrial

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Commercial

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Gas Insulated Transformer Market, By Type of Cooling

-

Introduction

-

Gas directed Air natural cooling

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Gas directed Air forced cooling

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Gas directed water forced cooling

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Global Gas Insulated Transformer Market, By Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Type, 2023-2032

- Market Estimates & Forecast by Voltage Rating, 2023-2032

- Market Estimates & Forecast Installation, 2023-2032

- Market Estimates & Forecast by End-User, 2023-2032

- Market Estimates & Forecast by Type of Cooling, 2023-2032

- U.S.

- Canada

-

Europe

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Type, 2023-2032

- Market Estimates & Forecast By Voltage Rating, 2023-2032

- Market Estimates & Forecast By Installation, 2023-2032

- Market Estimates & Forecast by End-User, 2023-2032

- Market Estimates & Forecast by Type of Cooling, 2023-2032

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Type, 2023-2032

- Market Estimates & Forecast By Voltage Rating, 2023-2032

- Market Estimates & Forecast By Installation, 2023-2032

- Market Estimates & Forecast by End-User, 2023-2032

- Market Estimates & Forecast by Type of Cooling, 2023-2032

- China

- Japan

- India

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Type, 2023-2032

- Market Estimates & Forecast By Voltage Rating, 2023-2032

- Market Estimates & Forecast by Installation,2023-2032

- Market Estimates & Forecast by End-User, 2023-2032

- Market Estimates & Forecast by Type of Cooling, 2023-2032

-

Competitive Landscape

-

Company Profile

-

ABB Ltd. (Switzerland)

- Company Overview

- Product/Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

General Electric (US)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Mitsubishi Electric Corporation (Japan)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Siemens AG (Germany)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Toshiba Corporation (Japan)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Arteche (Spain)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Meidensha Corporation (Japan)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Takaoka Toko co., ltd (Japan)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Fuji Electric co., Ltd. (Japan)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Chint Group (China)

- Company Overview

- Product /Services Offering

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis List of Tables

-

Global Gas Insulated Transformer Market: By Region, 2023-2032

-

North America Gas Insulated Transformer Market: By Country, 2023-2032

-

Europe Gas Insulated Transformer Market: By Country, 2023-2032

-

Asia-Pacific Gas Insulated Transformer Market: By Country, 2023-2032

-

RoW Gas Insulated Transformer Market: By Country, 2023-2032

-

Global Gas Insulated Transformer Market by Type: By Regions, 2023-2032

-

North America Gas Insulated Transformer Market by Type: By Country, 2023-2032

-

Europe Gas Insulated Transformer Market by Type: By Country, 2023-2032

-

Asia-Pacific Gas Insulated Transformer Market by Type: By Country, 2023-2032

-

RoW Gas Insulated Transformer Market by Type: By Country, 2023-2032

-

Global Gas Insulated Transformer Market, by Voltage Rating, By Regions, 2023-2032

-

North America Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

-

Europe Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

-

Asia-Pacific Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

-

RoW Gas Insulated Transformer Market, by Voltage Rating, By Country, 2023-2032

-

Global Gas Insulated Transformer Market, by Installation, By Regions, 2023-2032

-

North America Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

-

Europe Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

-

Asia-Pacific Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

-

RoW Gas Insulated Transformer Market, by Installation, By Country, 2023-2032

-

Global Gas Insulated Transformer Market, By End Use, By Regions, 2023-2032

-

North America Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

-

Europe Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

-

Asia-Pacific Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

-

RoW Gas Insulated Transformer Market, By End Use, By Country, 2023-2032

-

Global Gas Insulated Transformer Market, by type of cooling, By Regions, 2023-2032

-

North America Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

-

Europe Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

-

Asia-Pacific Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

-

RoW Gas Insulated Transformer Market, by type of cooling, By Country, 2023-2032

-

Global Gas Insulated Transformer Market: By Region, 2023-2032

-

North America Gas Insulated Transformer Market, By Country

-

North America Gas Insulated Transformer Market, by Type

-

North America Gas Insulated Transformer Market, By Voltage Rating

-

North America Gas Insulated Transformer Market, By Installation

-

North America Gas Insulated Transformer Market, By Type of Cooling

-

North America Gas Insulated Transformer Market, By End Use

-

Europe: Gas Insulated Transformer Market, By Country

-

Europe: Gas Insulated Transformer Market, by Type

-

Europe: Gas Insulated Transformer Market, By Application

-

Europe: Gas Insulated Transformer Market, By End-Use

-

Europe: Gas Insulated Transformer Market, By Type of Cooling

-

Europe: Gas Insulated Transformer Market, By End Use

-

Asia-Pacific: Gas Insulated Transformer Market, By Country

-

Asia-Pacific: Gas Insulated Transformer Market, by Type

-

Asia-Pacific: Gas Insulated Transformer Market, By Application

-

Asia-Pacific: Gas Insulated Transformer Market, By End-Use

-

Asia-Pacific: Gas Insulated Transformer Market, By Type of Cooling

-

Asia-Pacific: Gas Insulated Transformer Market, By End Use

-

RoW: Gas Insulated Transformer Market, By Region

-

RoW Gas Insulated Transformer Market, by Type

-

RoW Gas Insulated Transformer Market, By Application

-

RoW Gas Insulated Transformer Market, By End-Use

-

RoW Gas Insulated Transformer Market, By Type of Cooling

-

RoW Gas Insulated Transformer Market, By End Use List of Figures

-

RESEARCH PROCESS OF MRFR

-

TOP DOWN & BOTTOM UP APPROACH

-

MARKET DYNAMICS

-

IMPACT ANALYSIS: MARKET DRIVERS

-

IMPACT ANALYSIS: MARKET RESTRAINTS

-

PORTER’S FIVE FORCES ANALYSIS

-

SUPPLY CHAIN ANALYSIS

-

GLOBAL GAS INSULATED TRANSFORMER MARKET SHARE, BY TYPE, 2023 (%)

-

GLOBAL GAS INSULATED TRANSFORMER MARKET, TYPE, 2023-2032 (USD MILLION)

-

GLOBAL GAS INSULATED TRANSFORMER MARKETSHARE, BY VOLTAGE RATING, 2023 (%)

-

GLOBAL GAS INSULATED TRANSFORMER MARKET, BY INSTALLATION, 2023-2032 (USD MILLION)

-

GLOBAL GAS INSULATED TRANSFORMER MARKET, BY TYPE OF COOLING, 2023-2032 (USD MILLION)

-

GLOBAL GAS INSULATED TRANSFORMER MARKET, BY END USE, 2023-2032 (USD MILLION)

-

GLOBAL GAS INSULATED TRANSFORMER MARKET SHARE (%), BY REGION, 2023

-

GLOBAL GAS INSULATED TRANSFORMER MARKET, BY REGION, 2023-2032 (USD MILLION)

-

NORTH AMERICA GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

-

NORTH AMERICA GAS INSULATED TRANSFORMER MARKET BY COUNTRY, 2023-2032 (USD MILLION)

-

EUROPE GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

-

EUROPE GAS INSULATED TRANSFORMER MARKETBY COUNTRY, 2023-2032 (USD MILLION)

-

ASIA-PACIFIC GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

-

ASIA-PACIFIC GAS INSULATED TRANSFORMER MARKET BY COUNTRY, 2023-2032 (USD MILLION)

-

REST OF THE WORLD GAS INSULATED TRANSFORMER MARKETSHARE (%), 2023

-

REST OF THE WORLD GAS INSULATED TRANSFORMER MARKET BY COUNTRY, 2023-2032 (USD MILLION)

Leave a Comment