Fumed Silica Size

Fumed Silica Market Growth Projections and Opportunities

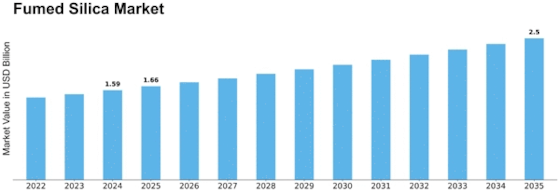

The Fumed Silica market is influenced by several enabling forces that have molded its dynamism. One key determinant is the increasing demand for silicone rubber in various industries. With popularity of silicone-based products on the rise, fumed silica, a crucial input in the production of silicone rubber, sees its demands go up. In particular, automotive and construction are at the forefront of this surge as fumed silica enhances performance and durability of silicone rubber within these sectors. Fumed Silica Market is expected to be valued at USD 1662.0 Million by 2030 with a CAGR of 6.8% during forecast period (2020 - 2030).

Another important factor influencing the Fumed Silica market is global economic trends. Investments in sectors using fumed silica such as pharmaceuticals, adhesives and sealants or coatings depend greatly on economic growth and stability. Conversely, there’s overall drop in spending when economics are bad thus affecting demand for fumed silica at large in these industries. More than that, this market can also be heavily affected by currency exchange rates linked to trade policies along with geopolitical factors that influence both pricing strategies and production costs associated with manufacturers of fumed silica.

Environmental regulations and sustainability initiatives are becoming increasingly influential in the Fumed Silica market. As environmental awareness grows attention shifts towards eco-friendly products development. Henceforth, sustainable solutions are required for different applications making use of versatile environmentally friendly materials like fume silica being sought after as an alternative today, globally . In order to comply with strict environmental standards and tap into emergent demand for sustainable goods manufacturers have therefore adjusted their manufacturing processes.

Innovation and technological advancements are other factors shaping Fumed Silica market dynamics substantially. The introduction of new varieties of fume-silicon dioxide having improved features as a result too ongoing R&D efforts helps cater to changing needs among end-users hence expanding potential markets too. Furthermore, improvements in production contribute to cost efficacy that is significant for competitive positioning by firms in this market.

Fumed Silica market’s dynamics are highly dependent on supply chain activities and availability of raw materials. Market prices of fumed silica are influenced indirectly by silica which is its major raw material. For example, any changes in the supply of silica that might be caused by factors like mining regulations, weather conditions and transportation charges may result into a direct impact on the availability and price of fumed silica. Consequently, manufacturers have put robust supply chain management strategies in place considering how sensitive the market is to such disruptions within its supply chains.

Competitiveness among players and industry consolidation drives Fumed Silica market dynamics significantly. The presence of many key participants involved in strategic actions aimed at consolidating their positions such as mergers, acquisitions or partnerships characterize the industry. This also means that competition along with pricing would be shaped by this trend alongside other related aspects such as market concentration and overall stability.Framework for Success

Leave a Comment