Fuel Card Size

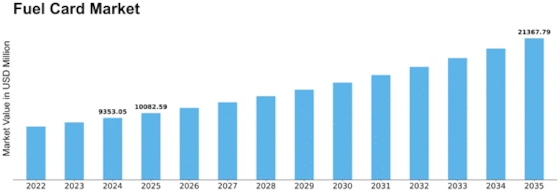

Fuel Card Market Growth Projections and Opportunities

A significant contributing factor is the increasing internationalization of businesses and the consequent rise in demand for highly qualified executive teams. As businesses expand their operations internationally, a more uniform fuel supply chain is necessary. gasoline cards provide a streamlined and useful setup that enables businesses to accurately monitor and manage gasoline expenses in many departments. Fuel cards are a vital tool used by both individuals and organizations to investigate these financial variations and find stability and predictability in their fuel expenses. Moreover, the overall expansion of the industry is further enhanced by the interest in gasoline card arrangements, which is often driven by financial growth and increased commercial exercises. Fuel card providers should continue to innovate to adapt to the shifting expectations of individuals and enterprises reliant on their services. To ensure the integrity and legality of their operations and contribute to the overall stability of the market, fuel card providers must investigate and adapt to emerging administrative frameworks. The behavior and preferences of buyers have a significant influence on the gasoline card industry. Fuel card arrangements that align with maintainability goals are becoming more and more popular as consumers grow more environmentally conscious. Suppliers who respond to this transition by providing carbon offset programs and eco-friendly vehicles will likely win over clients who care about the environment. It is imperative for gasoline card companies to comprehend and adapt to evolving consumer preferences to maintain and grow their market share. Suppliers often set themselves apart with features like loyalty programs, partnerships with gas stations, and enhanced customer experiences. Customers gain from this serious environment as it gives them options and encourages continuous development in the services provided by fuel card companies. International events and factors may also have an impact on the gasoline card industry. Risks in oil-producing regions, global tensions, or unforeseen global events can cause fluctuations in gasoline prices and have an impact on the overall market factors. Fuel card providers must to be open to these external influences and modify their protocols to investigate weaknesses and ensure the adaptability of their contributions in the face of unforeseen challenges.

Leave a Comment