French Fries Size

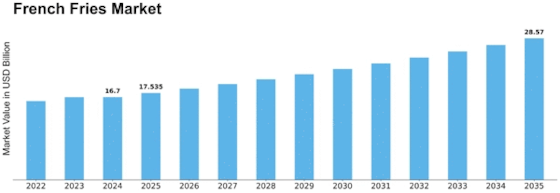

French Fries Market Growth Projections and Opportunities

The French Fries Market is influenced by a multitude of factors that contribute to its dynamics and growth. One of the primary drivers of this market is the widespread popularity of French fries as a versatile and beloved food item across the globe. As a ubiquitous side dish and snack, French fries have become a staple in various cuisines, from fast food to casual dining. The convenience and appeal of French fries make them a preferred choice for consumers of all ages, driving consistent demand and ensuring a steady market presence.

Consumer preferences and dietary trends play a significant role in shaping the French Fries Market. With an increasing focus on convenience and on-the-go consumption, the demand for frozen and pre-packaged French fries has risen. Moreover, changing dietary preferences, such as the shift towards plant-based and alternative ingredients, have led to the introduction of innovative options like sweet potato fries and other vegetable-based alternatives, addressing the evolving tastes and preferences of health-conscious consumers.

Economic factors, including disposable income and affordability, have a direct impact on the French Fries Market. Economic downturns may lead consumers to seek cost-effective and budget-friendly food options, while periods of economic stability may witness an uptick in the demand for premium or specialty French fries. The price sensitivity of French fries makes them responsive to changes in consumer purchasing power, making it crucial for manufacturers to adapt to economic fluctuations and offer products that cater to diverse market segments.

Supply chain and logistics are pivotal considerations in the French Fries Market, particularly in the case of frozen and processed products. The availability and pricing of key raw materials, such as potatoes, are influenced by factors like weather conditions, crop yields, and agricultural practices. Efficient supply chain management is essential for ensuring a stable and consistent flow of raw materials to meet the demand for French fries. Moreover, transportation and storage logistics play a critical role in preserving the quality of frozen French fries from production to retail shelves.

Health and wellness considerations are increasingly impacting the French Fries Market. As consumers become more conscious of their dietary choices, there is a growing demand for healthier and better-for-you alternatives. Manufacturers are responding by introducing baked, air-fried, or lower-fat versions of French fries. Additionally, transparent labeling and communication regarding ingredient sourcing, preparation methods, and nutritional information have become essential for building consumer trust in the quality and healthiness of French fries products.

Global events and cultural influences also shape the French Fries Market. Events such as the COVID-19 pandemic have influenced consumer behavior, leading to changes in dining habits, including increased demand for takeout and home delivery options. Cultural variations in taste preferences and culinary traditions impact the types of French fries offered in different regions, with flavors and seasonings adapting to local palates.

Environmental considerations and sustainability are gaining prominence in the food industry, including the French Fries Market. Consumers are increasingly concerned about the environmental impact of food production and packaging. This has prompted some manufacturers to adopt sustainable practices, such as using eco-friendly packaging materials, implementing energy-efficient production processes, and exploring responsible sourcing of potatoes.

Leave a Comment