Health-Conscious Consumer Trends

In recent years, the chocolate market in France has seen a significant rise in health-conscious consumer behavior. With an increasing awareness of health and wellness, many consumers are seeking chocolates that offer functional benefits, such as lower sugar content or added nutrients. Reports suggest that around 25% of chocolate sales in France now include products labeled as 'healthier' options. This shift is prompting manufacturers within the chocolate market to reformulate their products, incorporating ingredients like dark chocolate, superfoods, and natural sweeteners. Consequently, this trend not only caters to the evolving preferences of consumers but also positions the chocolate market as a versatile segment that can align with health and wellness goals.

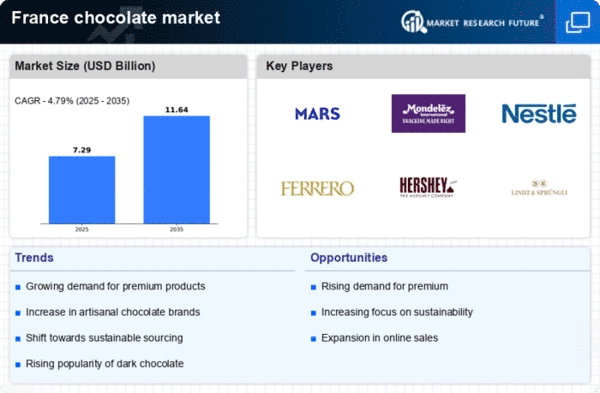

Growing Demand for Artisan Chocolates

The chocolate market in France is experiencing a notable shift towards artisan chocolates, driven by consumer preferences for unique and high-quality products. This trend indicates that approximately 30% of chocolate consumers in France are willing to pay a premium for artisanal offerings. The chocolate market is adapting to this demand by emphasizing craftsmanship and local sourcing, which enhances the perceived value of these products. As a result, small-scale chocolatiers are gaining traction, contributing to a diverse market landscape. This growing interest in artisan chocolates not only supports local economies but also fosters innovation within the chocolate market, as producers experiment with flavors and ingredients to cater to discerning palates.

Impact of E-commerce on Chocolate Sales

The chocolate market in France is witnessing a transformative impact due to the rise of e-commerce platforms. As online shopping becomes increasingly popular, it is estimated that e-commerce sales of chocolate products have surged by over 40% in the past year. This shift is reshaping the chocolate market, as brands invest in digital marketing strategies and online distribution channels to reach a broader audience. The convenience of online shopping, coupled with the ability to offer exclusive products, is attracting a new demographic of consumers who prefer purchasing chocolates online. This trend not only enhances accessibility but also encourages innovation in packaging and delivery methods within the chocolate market.

Cultural Influence on Chocolate Consumption

Cultural factors play a pivotal role in shaping the chocolate market in France. The country's rich culinary heritage and traditions surrounding chocolate consumption contribute to a unique market dynamic. Events such as holidays and festivals significantly boost chocolate sales, with the chocolate market experiencing peaks during occasions like Easter and Christmas. It is estimated that seasonal sales account for nearly 20% of annual chocolate revenue in France. This cultural affinity for chocolate encourages brands to create limited-edition products and themed packaging, thereby enhancing consumer engagement. As a result, the chocolate market continues to thrive, driven by the interplay between cultural practices and consumer preferences.

Sustainability Initiatives in Chocolate Production

Sustainability has emerged as a crucial driver within the chocolate market in France, as consumers increasingly prioritize ethical sourcing and environmentally friendly practices. The chocolate market is responding to this demand by implementing sustainable sourcing initiatives, with a focus on fair trade and organic certifications. Reports indicate that approximately 15% of chocolate sold in France is now certified organic or fair trade. This shift not only appeals to environmentally conscious consumers but also encourages transparency within the supply chain. As brands adopt sustainable practices, they enhance their reputation and foster loyalty among consumers who value ethical considerations in their purchasing decisions. This trend is likely to shape the future of the chocolate market, as sustainability becomes a key differentiator.