Formic Acid Size

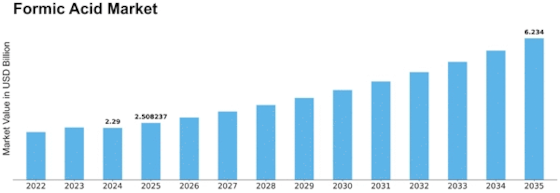

Formic Acid Market Growth Projections and Opportunities

The Global Formic Acid market is made up of various companies, including big ones (Tier 1) like BASF, Eastman Chemical Company, Feicheng Acid Chemical, and Perstorp AB, as well as smaller manufacturers. The majority of the market is controlled by these Tier 1 players. For example, BASF has recently opened a new production plant in Louisiana with an annual capacity of 50,000 tons. This expansion by key players, along with new production facilities in countries like China, India, and the rest of Asia Pacific, is contributing to the growth of the global formic acid market. China, in particular, plays a significant role, contributing over 50% of the overall production and being the largest consumer of formic acid.

The distribution of formic acid involves various channels such as distributors, retailers, wholesalers, and e-commerce. Distributors are companies that have long-term sales agreements with manufacturers and conduct extended business with customers in different industries. E-commerce is emerging as a new trend, with manufacturers using online platforms to sell their products. This trend is expected to grow with the increasing use of technology and the expansion of the e-commerce market.

Different industries use formic acid for various applications, such as preservatives, animal feed, rubber and leather production, cleaning agents, dyeing and finishing textiles, and others like pharmaceuticals, paper and coatings, and insecticides. Major consumers of formic acid are industries involved in preservatives, animal feed, and rubber and leather. Each industry has specific requirements for formic acid, leading to variations in its application across regions. The formic acid market is diverse, serving different needs in various industries worldwide.

In summary, the global formic acid market comprises a mix of large and small players, with key companies expanding production capacities to capture more market share. Distribution channels range from traditional methods to the growing influence of e-commerce. End users, representing various industries, have specific applications for formic acid, leading to its widespread use in different sectors across the globe. The market's dynamics are shaped by these factors, contributing to its overall growth and development.

Leave a Comment