Food Storage Container Size

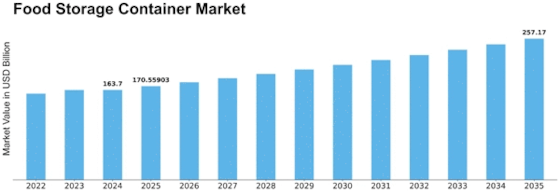

Food Storage Container Market Growth Projections and Opportunities

The demand for containers to store food is increasing worldwide, mainly because of the rise in online shopping in many countries. Other factors contributing to this demand include a growing global population, more people living in cities, and changes in lifestyles that affect what and how people eat. As a result, there's an increased need for containers to store both packaged and non-packaged food items, as well as ready-to-eat products that have a longer shelf life. The trend is particularly notable in developed countries where people lead busy lives and want convenient food options for the future.

The global market for food storage containers is expected to grow at a rate of 4.52% between 2020 and 2026. In 2019, Asia-Pacific dominated this market with a 34.2% share, followed by North America at 28.5% and Europe at 17.4%.

The market is segmented based on the material used, including metal, paper, plastic, glass, and others. Plastic, particularly types like PET, PP, HDPE, and LDPE, accounted for the largest market share (35.4%) in 2019, with a value of USD 70.8 billion, and is expected to continue growing at a rate of 4.2%.

In terms of packaging type, the market is divided into rigid and flexible packaging. Flexible packaging, including items like bags and pouches, held the largest market share (61.2%) in 2019, valued at USD 122.5 billion. The flexible packaging segment is projected to reach USD 149.3 billion by 2026.

Container types, such as bags, pouches, and containers, were also considered. Containers are expected to contribute the most to the market, reaching a value of USD 135.8 billion by 2026 and growing at the highest rate (4.77%) during the forecast period.

Lastly, the market is segmented based on the application of these containers, such as for fruits, vegetables, dairy products, meat, candy, confections, grain mill products, and bakery items. The bakery products segment is expected to experience the fastest growth during the forecast period, holding a 24.4% share in 2019.

In conclusion, the increasing demand for food storage containers is driven by various factors, and the market is expected to see substantial growth in the coming years, especially in the plastic and flexible packaging segments.

Leave a Comment