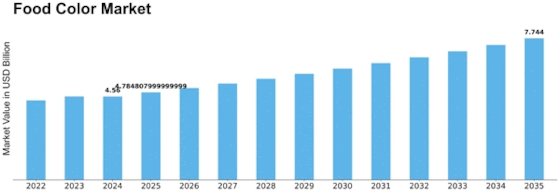

Food Color Size

Food Color Market Growth Projections and Opportunities

The food color market is influenced by several key factors that shape its growth and dynamics. Firstly, consumer preferences and perceptions of food color play a significant role in driving market demand. Colors are an essential aspect of food presentation, influencing consumers' perceptions of taste, flavor, and overall appeal. As consumers become more health-conscious and aware of the potential risks associated with synthetic food colors, there is a growing preference for natural and plant-based alternatives. This shift towards clean-label and natural ingredients has driven the demand for natural food colors derived from sources such as fruits, vegetables, and spices.

Secondly, the expansion of the food and beverage industry, particularly in emerging economies, has fueled demand for food colors. As disposable incomes rise and consumer preferences evolve, there is a greater demand for visually appealing and aesthetically pleasing food and beverage products. Food colors play a crucial role in enhancing the appearance of various food and beverage products, including confectionery, baked goods, beverages, and snacks. Manufacturers are increasingly incorporating food colors to differentiate their products and attract consumers in a competitive market landscape.

Moreover, regulatory factors play a significant role in shaping the food color market. Government regulations and food safety standards govern the use of food additives, including colors, in food and beverage products. Compliance with these regulations is essential for manufacturers to ensure product safety, quality, and consumer trust. Additionally, regulatory changes and updates can impact ingredient sourcing, formulation, labeling, and marketing practices, influencing market dynamics and driving manufacturers to adapt and innovate accordingly.

Another significant factor influencing the food color market is technological advancements and innovation in ingredient formulation and processing. Manufacturers are continually investing in research and development to improve the functionality, stability, and sensory properties of food colors. This innovation allows manufacturers to meet the diverse needs and preferences of consumers, including those seeking natural, vibrant, and stable colors in their food and beverage products. Additionally, advances in extraction and processing technologies enable the production of natural food colors with enhanced performance and versatility, driving market growth and diversification.

Furthermore, the influence of health and wellness trends cannot be overlooked in shaping the food color market. As more consumers prioritize healthier lifestyles and dietary choices, there is a growing demand for food colors that are perceived as safe, natural, and free from synthetic additives. Natural food colors offer an attractive alternative to synthetic colors, appealing to health-conscious consumers seeking clean-label options. Additionally, the rise of plant-based eating trends has driven demand for plant-derived food colors, further driving market growth and innovation.

Additionally, the globalization of food supply chains has contributed to the growth of the food color market. With increased international trade and cross-border commerce, manufacturers have access to a diverse range of natural food color ingredients sourced from different regions around the world. This globalization of ingredient sourcing enables manufacturers to offer a wide variety of food color options to meet the diverse preferences and cultural tastes of consumers in different markets. Additionally, it fosters collaboration and innovation within the food color industry, driving market expansion and competitiveness.

Leave a Comment