Fluoropolymers Size

Fluoropolymers Market Growth Projections and Opportunities

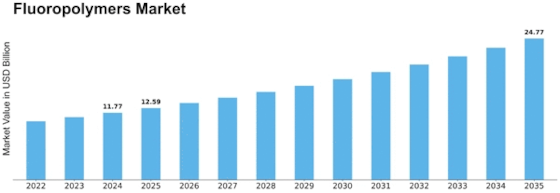

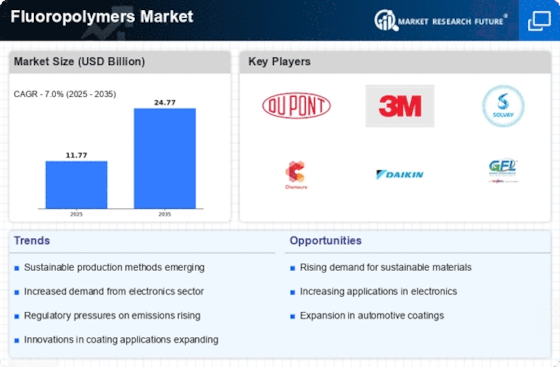

Fluoropolymers Market Size was valued at USD 9 Billion in 2022. The Fluoropolymers market industry is projected to grow from USD 11 Billion in 2023 to USD 18 Billion by 2030, exhibiting a compound annual growth rate (CAGR) of 7.00%

Wide Range of End-Use Applications: The Fluoropolymers market experiences significant demand from various end-use industries, including automotive, electronics, chemical processing, construction, and healthcare. Fluoropolymers, such as polytetrafluoroethylene (PTFE), polyvinylidene fluoride (PVDF), and fluorinated ethylene propylene (FEP), offer exceptional properties such as chemical resistance, thermal stability, low friction, and electrical insulation. These properties make fluoropolymers ideal materials for diverse applications such as automotive components, electrical cables, chemical processing equipment, architectural coatings, and medical devices.

Growing Demand for High-Performance Materials: The increasing demand for high-performance materials is a key driver of the Fluoropolymers market. Industries such as aerospace, automotive, and electronics require materials that can withstand harsh operating conditions, extreme temperatures, and corrosive environments while offering superior performance and reliability. Fluoropolymers meet these requirements and are preferred for critical applications where conventional materials may not perform adequately. As industries continue to demand high-performance materials to improve efficiency, durability, and safety, the demand for fluoropolymers is expected to grow.

Technological Advancements Driving Innovation: Technological advancements in fluoropolymer manufacturing processes and applications are driving innovation and expanding the Fluoropolymers market. Manufacturers are investing in research and development to develop advanced fluoropolymer formulations with improved properties such as enhanced chemical resistance, thermal stability, and processability. These advancements enable fluoropolymers to meet the evolving needs of end-users across various industries and drive market growth through product differentiation and innovation.

Regulatory Compliance and Environmental Considerations: Regulatory compliance and adherence to environmental considerations play a crucial role in shaping the Fluoropolymers market. Fluoropolymers are subject to regulations governing chemical substances and environmental standards to ensure product safety, environmental sustainability, and compliance with health and safety regulations. Compliance with regulatory requirements and certifications is essential for manufacturers to gain market approval, maintain consumer trust, and meet the demands of both consumers and regulatory authorities.

Rising Demand for Sustainable Solutions: The rising demand for sustainable solutions is driving the adoption of fluoropolymers in various industries. Fluoropolymers offer advantages such as durability, longevity, and recyclability, making them attractive materials for applications where sustainability is a priority. Industries are increasingly incorporating fluoropolymers in their products and processes to reduce environmental impact, minimize waste generation, and meet sustainability goals. As sustainability continues to gain importance across industries, the demand for fluoropolymers as eco-friendly materials is expected to increase.

Emerging Applications in Healthcare and Medical Devices: Fluoropolymers are finding emerging applications in the healthcare and medical devices industry. Medical-grade fluoropolymers, such as PTFE and FEP, offer properties such as biocompatibility, chemical inertness, and low friction, making them suitable materials for medical implants, surgical instruments, catheters, and drug delivery systems. With the growing demand for advanced medical devices and implants to meet the healthcare needs of an aging population, the demand for fluoropolymers in the healthcare sector is expected to rise.

Market Fragmentation and Competitive Landscape: The Fluoropolymers market exhibits fragmentation with numerous manufacturers and suppliers competing for market share. Intense competition among key players and new entrants in the market necessitates differentiation through product innovation, quality assurance, and customer service. Market players are focusing on expanding their product portfolios, leveraging advanced technologies, and establishing strong partnerships to gain a competitive edge in the highly competitive Fluoropolymers market.

Price Volatility of Raw Materials: Price volatility of raw materials, particularly fluorine-based chemicals, can impact the Fluoropolymers market. Fluoropolymers are derived from fluorine-based chemicals such as fluorite, hydrofluoric acid, and chlorofluorocarbons (CFCs), which are susceptible to price fluctuations influenced by factors such as supply-demand dynamics, geopolitical tensions, and regulatory changes. Fluctuations in raw material prices can affect the production costs of fluoropolymers and subsequently influence market dynamics and pricing strategies.

Leave a Comment