Sustainability in Flooring Materials

The Flooring Market is increasingly influenced by the demand for sustainable materials. Consumers are becoming more environmentally conscious, leading to a rise in the use of eco-friendly flooring options such as bamboo, cork, and recycled materials. This shift is not merely a trend; it reflects a broader societal movement towards sustainability. According to recent data, the market for sustainable flooring is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. Manufacturers are responding by innovating and developing products that meet these eco-friendly standards, thereby enhancing their market position. As a result, the Flooring Market is likely to see a substantial transformation, with sustainability becoming a core component of product offerings.

Economic Growth and Consumer Spending

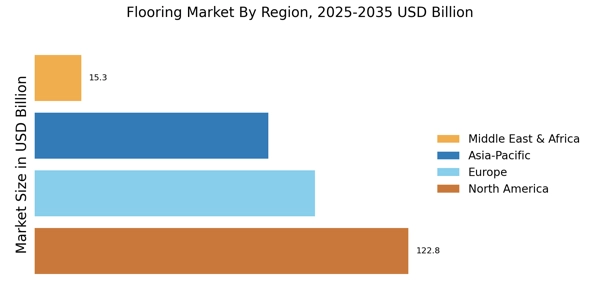

Economic growth plays a pivotal role in shaping the Flooring Market, as rising disposable incomes lead to increased consumer spending on home improvement and renovation projects. As economies recover and expand, consumers are more inclined to invest in high-quality flooring solutions that enhance their living spaces. Market data suggests that regions experiencing robust economic growth are witnessing a corresponding rise in flooring sales, particularly in premium segments such as hardwood and luxury vinyl. This trend indicates that the Flooring Market is closely tied to broader economic indicators, with consumer confidence and spending patterns directly influencing market dynamics. As such, manufacturers must remain attuned to economic trends to effectively capitalize on emerging opportunities.

Technological Advancements in Flooring

Technological innovations are reshaping the Flooring Market, introducing new materials and installation techniques that enhance performance and aesthetics. The advent of digital printing technology allows for intricate designs and patterns that were previously unattainable. Moreover, advancements in manufacturing processes have led to the development of more durable and resilient flooring options, such as luxury vinyl tiles and engineered hardwood. Data indicates that the market for technologically advanced flooring solutions is expanding, with a notable increase in demand for smart flooring that integrates with home automation systems. This trend suggests that the Flooring Market is on the cusp of a technological revolution, where innovation plays a pivotal role in meeting consumer expectations and driving sales.

Customization and Personalization Trends

The Flooring Market is witnessing a growing trend towards customization and personalization, as consumers seek unique solutions that reflect their individual tastes and preferences. This shift is evident in the increasing demand for bespoke flooring designs, colors, and textures. Manufacturers are responding by offering a wider range of customizable options, allowing consumers to create flooring solutions that align with their specific needs. Market data reveals that personalized flooring products are gaining traction, with a significant portion of consumers willing to pay a premium for tailored solutions. This trend not only enhances customer satisfaction but also fosters brand loyalty, as consumers are more likely to return to brands that offer personalized experiences. Consequently, the Flooring Market is evolving to prioritize customization as a key driver of growth.

Urbanization and Infrastructure Development

Urbanization is a critical driver of the Flooring Market, as increasing population densities in urban areas lead to heightened demand for residential and commercial spaces. This trend is accompanied by significant infrastructure development, including new housing projects, commercial buildings, and public facilities. As cities expand, the need for durable and aesthetically pleasing flooring solutions becomes paramount. Market analysis indicates that regions experiencing rapid urban growth are likely to see a surge in flooring demand, particularly for materials that can withstand high foot traffic and environmental stressors. This urban-centric growth presents opportunities for manufacturers to innovate and cater to the specific needs of urban dwellers, thereby positioning themselves favorably within the Flooring Market.