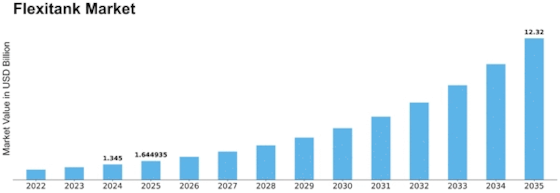

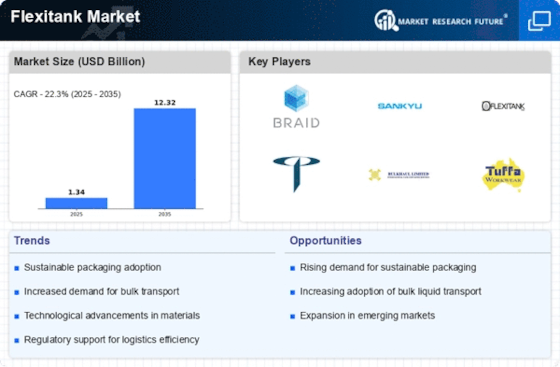

Flexitank Size

Flexitank Market Growth Projections and Opportunities

Numerous market components influence the Flexitank market, which is a crucial participant in mass fluid transportation. These factors primarily shape the industry's development, reception, and overall elements. The global exchange variables that affect the Flexitank industry are unpredictable, and fluctuations in import/trade policies impact the need for flexible fluid vehicle arrangements. The utilization of flexitanks as an innovative and efficient way to move bulk fluids is directly impacted by changes in exchange examples and quantities. Flexitanks' affordability when compared to traditional shipping methods is a major factor in their acceptance. Flexitanks' financial advantages, especially for non-hazardous fluid transportation, increase their appeal and market credibility. Flexitanks' wide range of applications is further enhanced by their versatility in handling various fluid goods, such as food-grade fluids, synthetic materials, and horticulture products. The market share of flexitanks in various regions is shaped by industry-explicit interest in mass fluid transportation systems. Flexitanks' market recognition and seriousness are increased by features like temperature control, multi-facet development, and anti-sloshing systems. Growing natural awareness influences the choice of bulk fluid transportation methods, favoring environmentally friendly configurations such as flexitanks. Flexitanks' commercial relevance is increased by their manageability, which aligns with green practices and lower carbon footprints. Flexitanks must comply with international standards and regulations governing the transportation of liquids to be accepted in the marketplace. Respecting health and quality standards ensures that flexitanks satisfy the needs of various businesses, fostering confidence among collaborators. Businesses with distinct shipping volume requirements can have their varied demands met by the flexibility of flexitanks, which can be stretched to a variety of sizes and restrictions. By providing a variety of sizes, flexitanks increase their market share in a variety of fluid vehicle applications and improve their flexibility. The serious scene has a crucial role in market components, as does the quantity and quality of flexitank suppliers. Strong ties between flexitank manufacturers and operational suppliers contribute to market leadership, consistent quality, and customer loyalty. For flexitank shipments, the availability of comprehensive protection options and risk-based solutions is essential for gaining market recognition. Assuring partners of the consistent quality of this mode of transportation enhances the validity and market share of flexitanks by providing proof against any threats. Flexitanks' market share and adaptability on the global arena are enhanced by their capacity to adapt to shifting foreign scenarios.

Leave a Comment