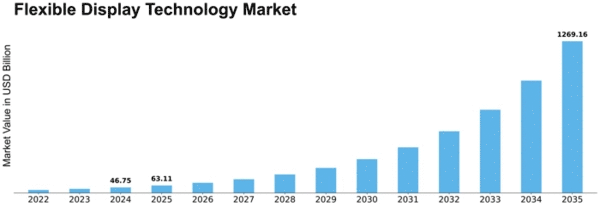

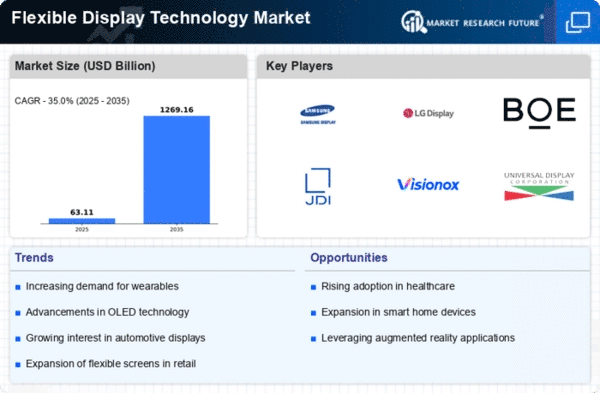

Flexible Display Technology Size

Flexible Display Technology Market Growth Projections and Opportunities

Many aspects affect the flexible display technology market and determine its trend. Advances in technology are a major force, with new innovations carrying the market forward. In the manufacturing process, breakthrough R & D efforts give rise to displays not only flexible but also better in terms of durability, resolution and other functions. Such technological advances help the market grow by providing consumers with versatile, high-performance devices. Demand leads manufacturers to produce products incorporating the latest technology, with designs that will provide a unique look and feel. The flexible display technology market is ultimately dictated by consumer preferences. With an increasing demand among users for slimmer, lighter gadgets and good looks. Having a flexible display becomes one of the defining selling points when it comes to electronic products. Understanding and responding to consumer demand are important market factors which guide enterprises' product development strategies. In today's market, economic downturn could change consumer spending habits and distort trajectory. Furthermore, the price and supply of raw materials like polymers or conductive components used in flexible displays can affect production costs and thereby influence market competition. These are just some of the economic factors that manufacturers must take into account to survive and stay in business. What is more, the fusion of flexible display technology in different industries beyond consumer electronics serves as an important market factor. Their applications in automotive dashboards, medical devices and other fields outside their traditional ones all contribute to the market's growth. This diversification creates new opportunities for manufacturers and allows the technology to be tailored to a wider range of needs and interests. The flexible display technology market is also influenced by supply chain interruptions and geopolitical factors. Geopolitical tensions, trade disputes and global events affect the supply of critical ingredients and manufacturing facilities in producing flexible displays.

Leave a Comment